If we are serious about decarbonising the economy in a timeframe that matters, we need to be able to leverage the existing infrastructure and energy resources as much as possible. Building an entire new energy infrastructure from scratch will take too long, involve too much material and face resistance from incumbents, who, understandably, don’t want to write off trillions of fossil assets. (What is the energy transition equivalent of RealPolitik? RealElectrik?) The exigencies of climate action means we don’t have the luxury of maintaining ideological purity. The work of 8 Rivers, and their spin-out, Net Power, are highly differentiated in the climate tech space because of their focus on decarbonising fossil fuels and their approach to innovation and scaling. This week I tuned into 8 Rivers CEO Cam Hosie on the MCJ Podcast and I’m also drawing on some material from Bill Brown’s segment on this webinar from a year ago (relevant segment from min 13:30 in the video). Key takeaway: We need to collectively be focussed on scalable solutions that meet the world where it is and enable large-scale activation of production (i.e. corporate) and financial capital. There is no such thing as the path we should take to transition - it will be dictated by the economics.

8 Rivers is an IP company that develops industrial decarbonisation solutions across power, chemicals, carbon removal. They are focussed on infrastructure-scale applications, that are deployable today, generally physically handling CO2. They develop technology in-house, but also integrate third party technologies.

Five principles for the rolling out decarbonisation infrastructure:

Use existing equipment, off-the-shelf, readily available (it took Net Power 8 years to bring their invention to commercialisation - too long).

Use the same piece of equipment to generate multiple revenue streams, co-generation of commodities, look at combining various industries - power, liquid fuels, chemicals

Keep the waste in the system (e.g. use the CO2 as valuable input, use the nitrogen for ammonia production)

Link the systems to create ecosystems - ecosystem needs to be built on foundation of deep and liquid commodity markets

Create the Spark - need the catalyst to ignite capital markets, provide markets with the industrial infrastructure investments that create the value that provide high returns (“AUM Machine”)

There is great urgency for deployment because, if we take 2050 as a date for Net Zero, we only have a couple of cycles of infrastructure deployment. According to Cam Hosie, infrastructure deployment generally follows a power scaling, so that if there are 2 plants in the first cycle, then there will be 4 in the next and 16 in the next (i.e. not enough to make a dent). But if you can push it so that you get 10 in the first cycle, then it goes to 100 and 10,000. Now we’re talking. [I’m not sure where he got these numbers from but would appreciate a steer if anyone understands the basis for it.]

Technologies need to be able to be deployed everywhere, as emissions come from everywhere, global issue, so can’t count on country-specific policies. Also, there is a moral imperative to enable emerging markets to develop using the resources available to them, including fossil fuels, so need to find a way for them to be used in a way that doesn’t have the associated carbon emissions.

Cam Hosie acknowledges there are remaining challenges with natural gas around leakage from production and transport, but just a technical problem to be solved - and 8 Rivers are working on solutions - not an inherent feature.

Net Power: Net Power was spun up by 8 Rivers to commercialise the Allam-Fetvetd cycle developed in-house. The company was funded and substantially run by 8 Rivers for the early part of its life and then was gradually separated as new partners came to the table - McDermott, Occidental, Constellation Energy and, recently, Baker Hughes (who, incidentally, recently acquired Mosaic Materials, a company developing organic metal framework for CO2 capture)

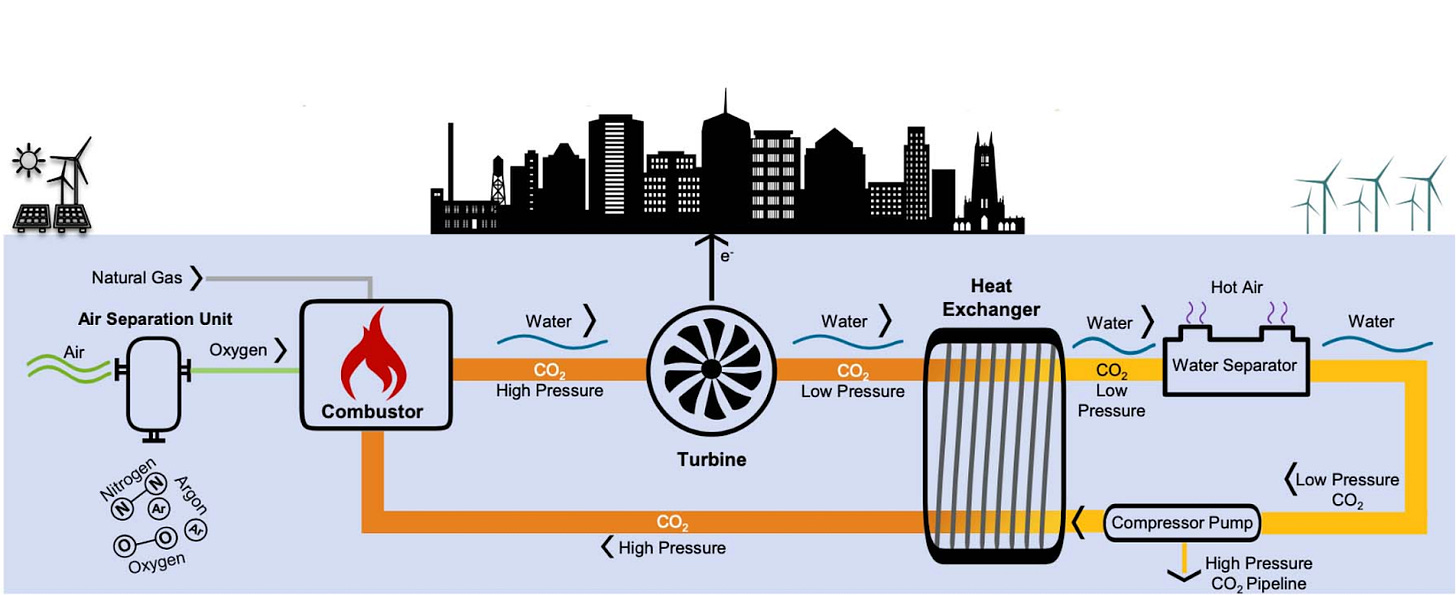

Allam-Fedvedt Cycle turns the problem of problem of post-combustion capture on its head. Generally it is expensive to capture CO2 even in a more concentrated flu gas because it still needs to be separated from the nitrogen. The Allam Cycle uses oxy-combustion (burning natural gas with oxygen, in this case pre-mixed with CO2) so that the only outputs are carbon dioxide and water (CH4 + 2O2 -> CO2 + 2H2O). The CO2 from the combustion is used as the working fluid to drive the turbine (instead of, say, steam), with the excess filtered off to be sequestered. Genius!

Net Power are now developing a number of 300-ishMW plants in the UK and the US - three announced so far, more in the works.

8 Rivers recently secured a $100mm investment from SK Group, the Korean industrial conglomerate, some of the first external capital they’ve brought into the topco. SK has a goal to remove 200 million tonnes of CO2 from their operations by 2030 and will form a JV to roll out 8 Rivers’ solutions in Asia - the most important theatre in the climate battle.

Hydrogen: 8 Rivers has developed a way to do hydrogen from steam methane reforming with capture (that would be ‘blue’ hydrogen for anyone who cares), using additional oxygen and a cryogenic CO2 capture system, which, apparently, amazingly, produces hydrogen more cheaply than unabated fossil production. Note also that this system, branded 8RH2, was specifically mentioned in the SK announcement. SK is part of a group of Korean industrials that formed a hydrogen alliance last year.

Direct Air Capture - 8 Rivers have developed a DAC solution using mineralisation, Calcite, which recently came out of stealth as one of the winners of the first round of the X Prize for Carbon Removal. Calcite uses the same mineralisation loop as Heirloom, using calcium hydroxide to bind with the atmospheric CO2 to create calcium carbonate, then using heat to drive off the pure CO2. Not enough details to understand the differentiation between the two companies, but would welcome input if anyone knows.