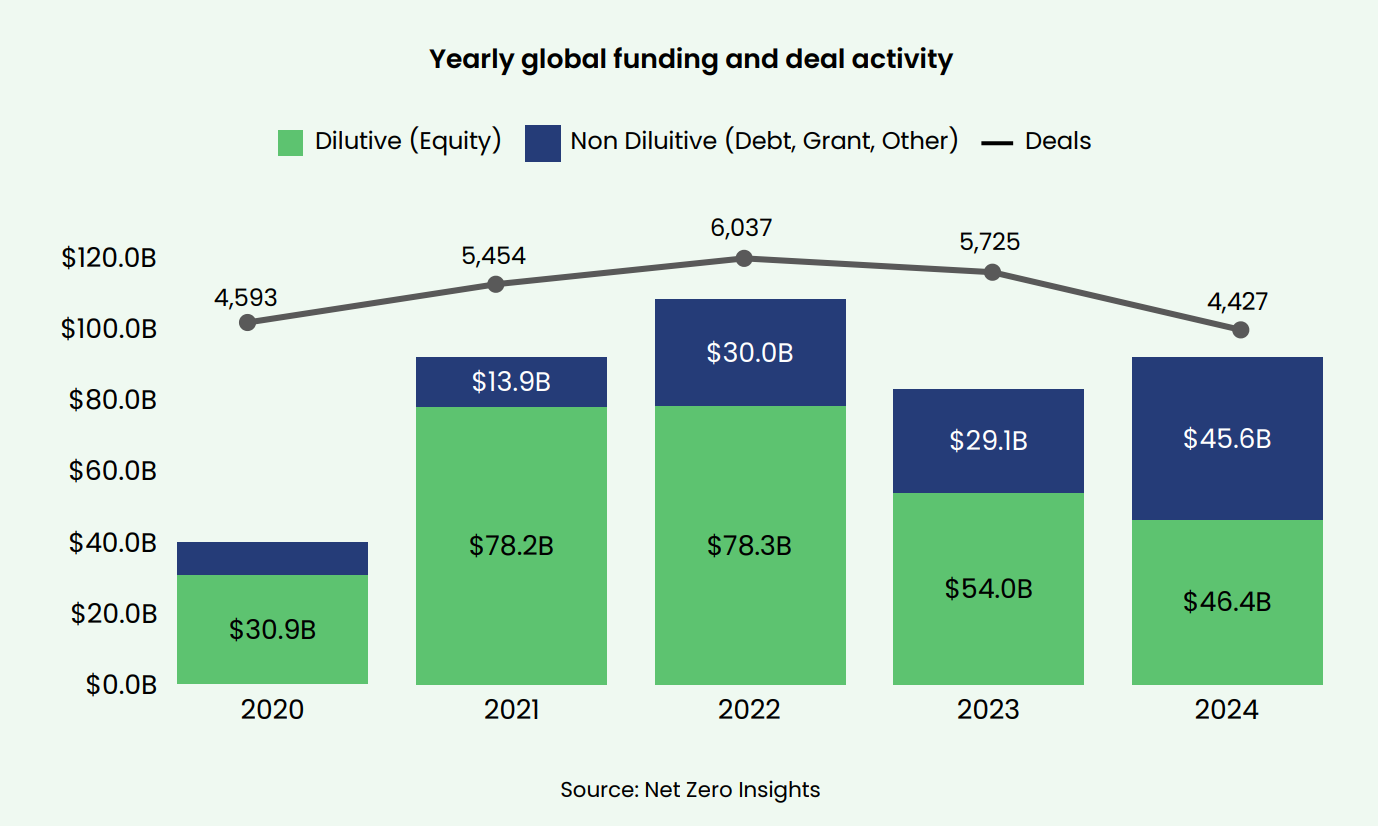

Net Zero Insights just put out their excellent 2024 full year climate tech report (get the full thing here). There is enough to go through that I thought there would be some value in distilling down my takeaways here (my own thoughts in italics below). There isn’t a crisp story to be told here. The biggest development is the massive increase in debt financing, headlined by the Northvolt deal at the start of the year. Given that detail, we’ll have to see if that trend can continue. Meanwhile, there seems to be a continued retreat of generalists investors as the number of unique investors shrank. For that to reverse, in my view, we’ll need to see a significant more robust environment than we did in 2024.

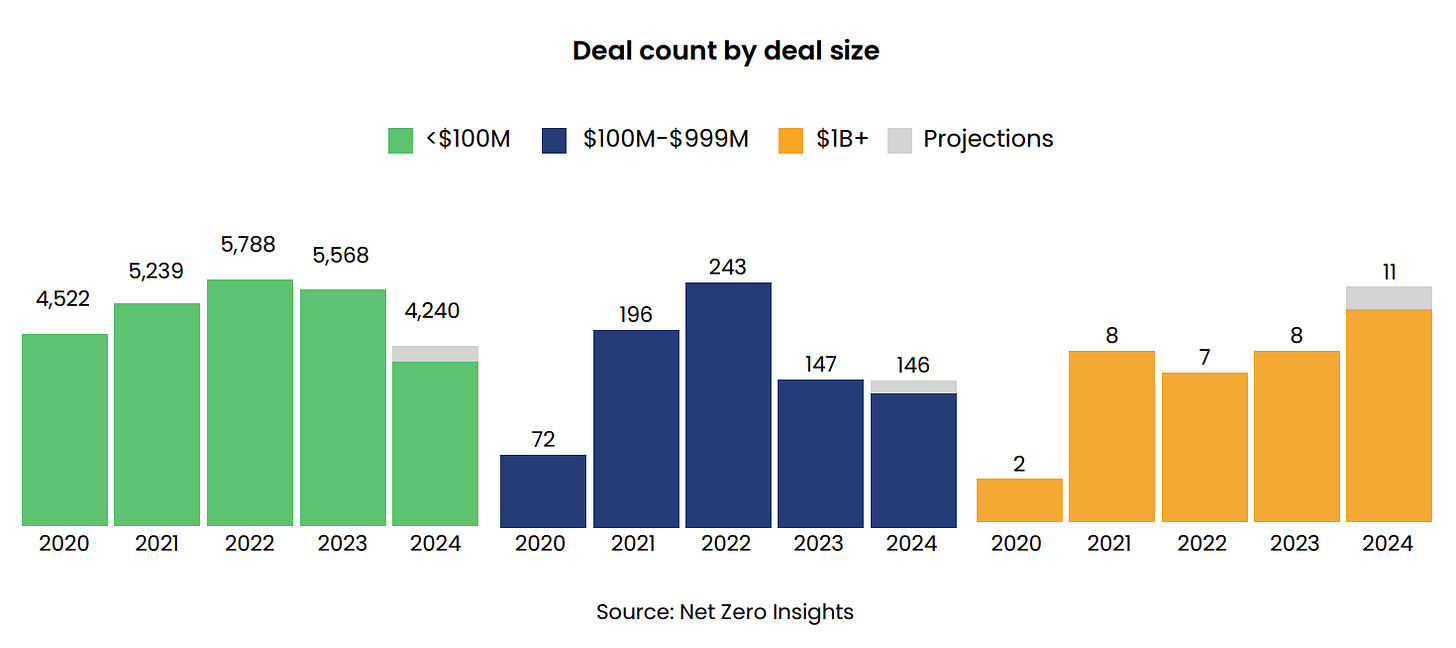

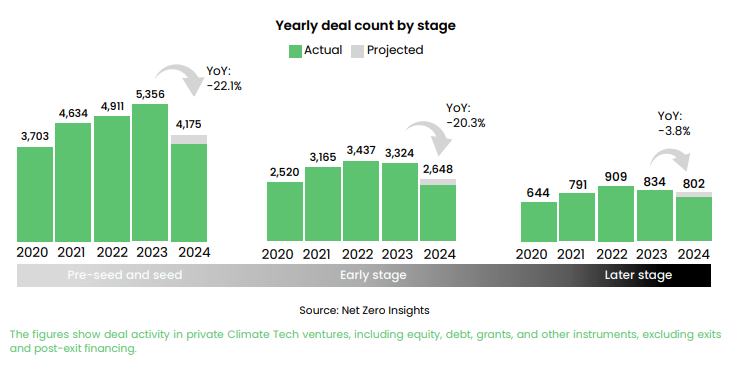

Fewer, bigger deals: Deal count is dropping, but the quantum of capital is broadly stable as capital shifts towards more scalable opportunities and also shifts more towards debt.

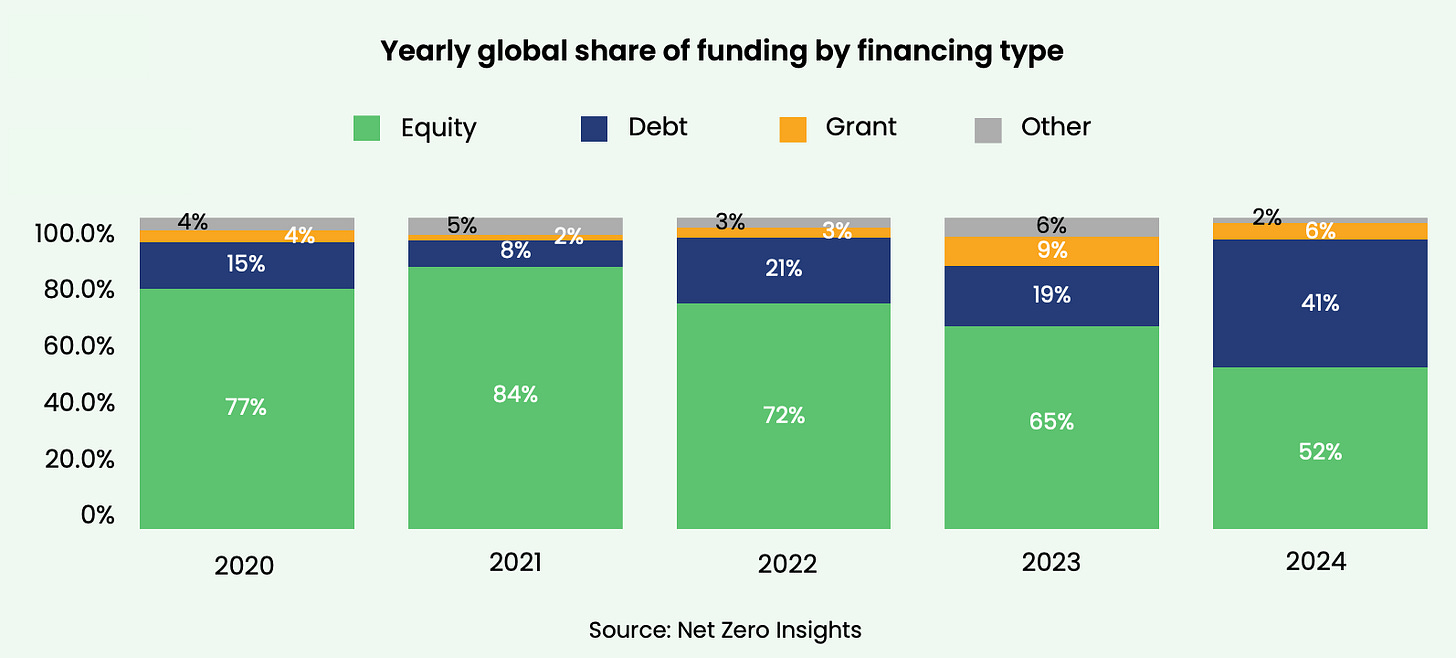

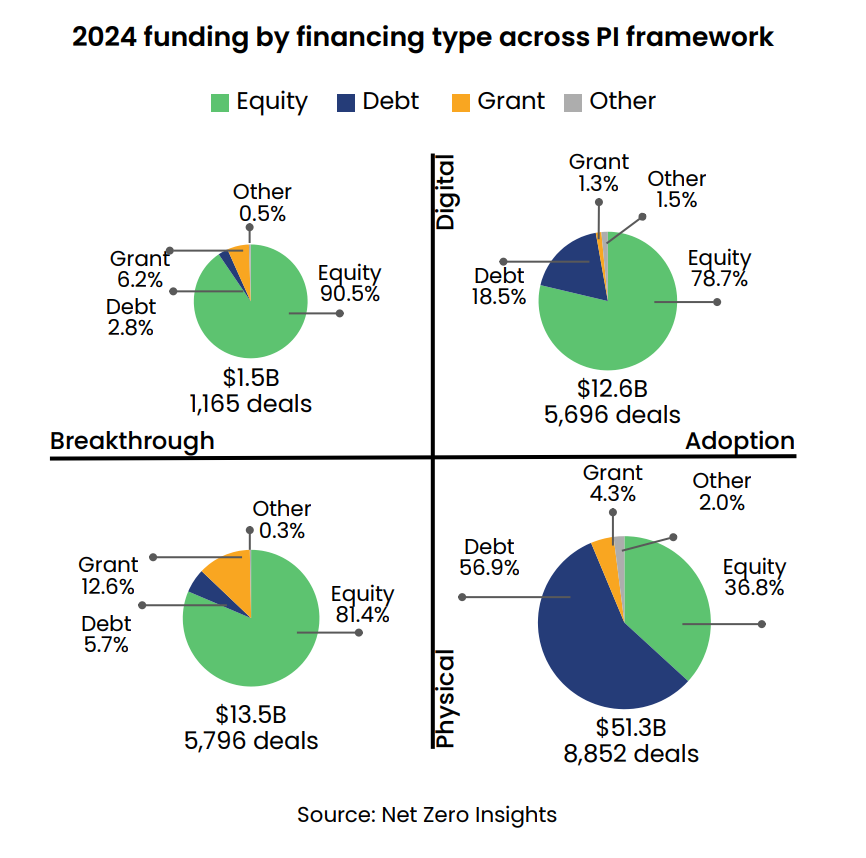

The shift towards debt is even more obvious in this chart:

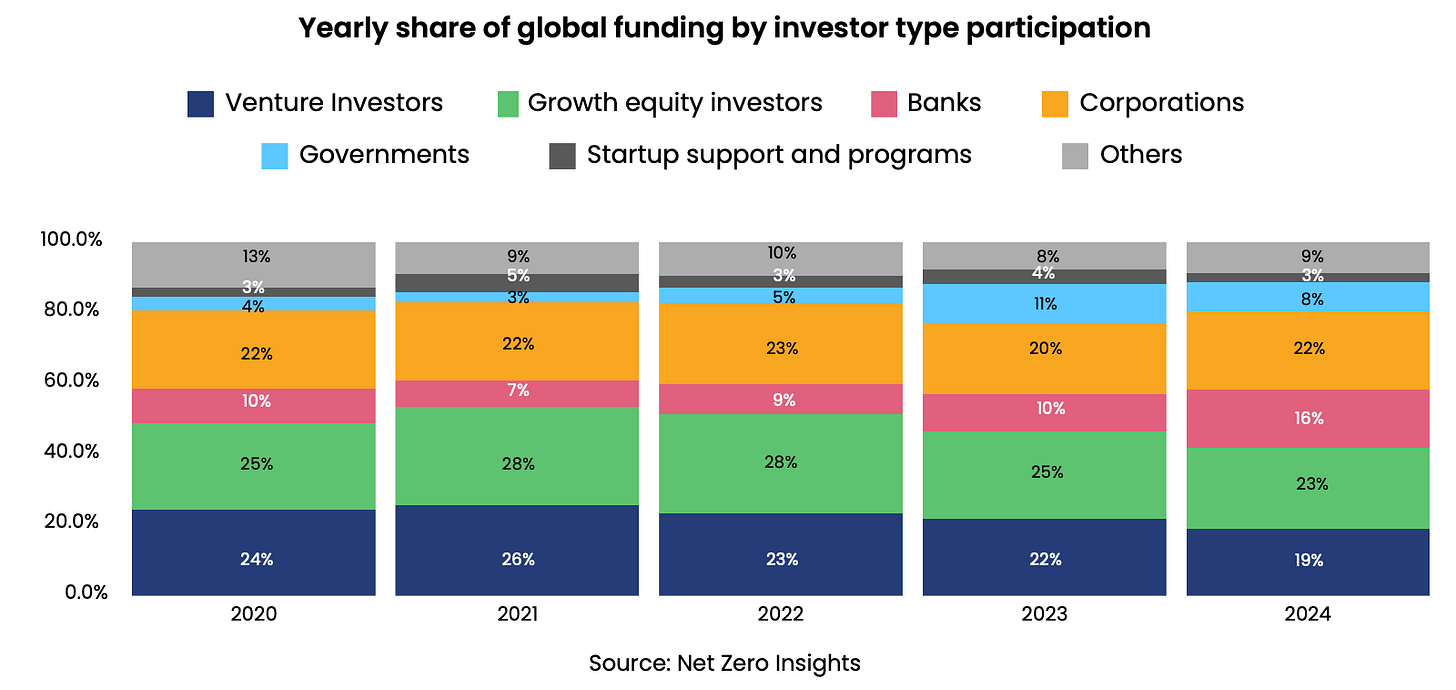

With a correspondingly smaller role for VCs and growth equity, and a bigger role for banks:

The shift towards debt as a greater portion of the funding is, on balance, a welcome development and shows maturation of the market. Availability of debt is the thing that signals that companies are maturing from the relatively smaller venture world towards truly deep pools of infrastructure capital (hurdling the valley of death). It is unfortunate in the extreme that the largest debt deal this year - $5bn to Northvolt announced at the start of this year - has gone up in flames. Northvolt was deemed by blue chip lenders to be sufficiently de-risked to be debt-worthy and they royally screwed it up. We have to hope that their lenders have sufficient scale and long-term perspective to take this loss as something idiosyncratic and not leave them gun-shy across the energy transition as a whole. We’re all rooting for Stegra (fka H2 Green Steel) to make good on the $4.2bn it borrowed around the same time!

It is worth noting on the data here that NZI includes some deals to very mature companies that many might not think of as climate tech because of their age - companies like Holtec in the nuclear space or a Finnish district heating provider.

Continued retreat of generalists: According to NZI the number of unique investors declined in both the US (-15%) and in Europe (-12.5%). Meanwhile Sightline’s recent Dry Powder report suggests an 18% drop in the number of unique investors from last year.

In our discussions with VC managers it has been a consistent theme that there is a dearth of generalist investors all the way until the late-growth stage. Climate tech is no longer hot and tourists that might have misstepped during the heady times at the top of the market are gun-shy, with individual investors on their teams facing enhanced career risk for being somewhat out of consensus (same as it ever was!) and backing climate companies. This represents both a challenge for early stage companies that need to raise more significant amounts of capital and an opportunity for savvy investors with dry powder around the “late A” and series B stages.

Shift to larger deal size: The relative stability of investment dollars was driven by the uptick in gigarounds (>1bn), whilst megarounds ($100-999mm) were stable from last year. Of course, the absolute number of these large rounds were a tiny fraction of those <$100mm, which saw a steep decline from 2023. NZI also splits the deals between pre-seed/seed, early- and late-stage. Unhelpfully, they don’t define what each of these mean and it’s hard to infer from the examples given, but it is consistent with a slowdown for small deals / early stage and relative stability at later stages.

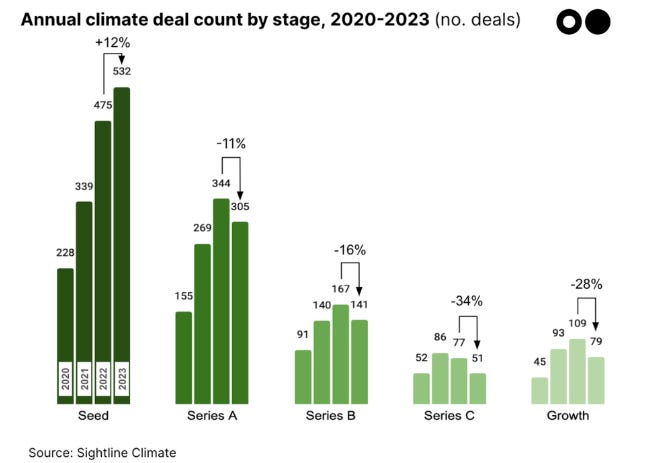

On one level, the drop in the deal count at the earlier stage and relative resilience at later stage is puzzling. The early stage is robustly capitalised by a well populated (let’s be honest, “over populated”) group of early stage climate funds. However, there seems to be an element of lag here as the early stage has been slower to correct. Whilst Series A+ peaked in 2022 or even 2021, the count of seed deals continued to grow through to last year - see below from last Sightline’s 2023 report, which labels the rounds more clearly. Anecdotally, we know that a lot of early stage funds now have a lot of focus on supporting their companies in graduating to the next round, slowing deployment. Many early stage funds raised during 2020 and 2021 will also be reaching the end of their investment periods over the next 12 months or so. In our view many of those will struggle to raise their next funds, so we should see consolidation at that end of the market.

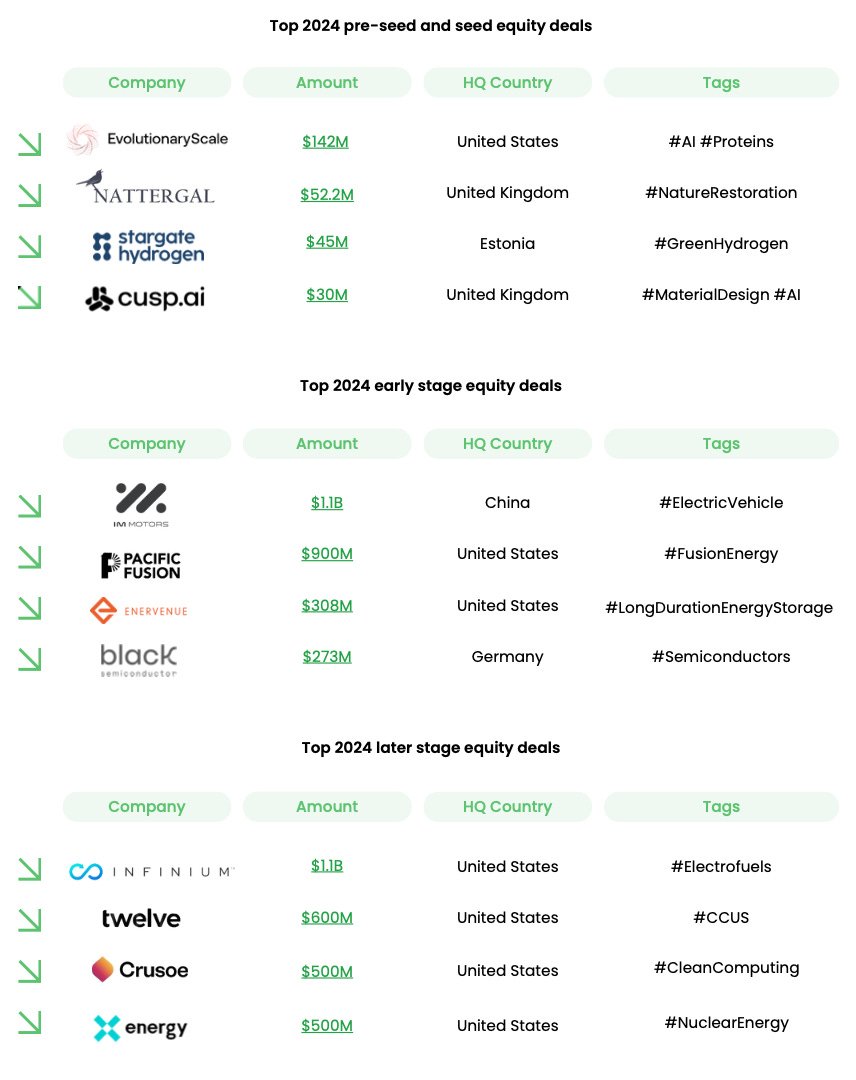

Some of the major deals this year:

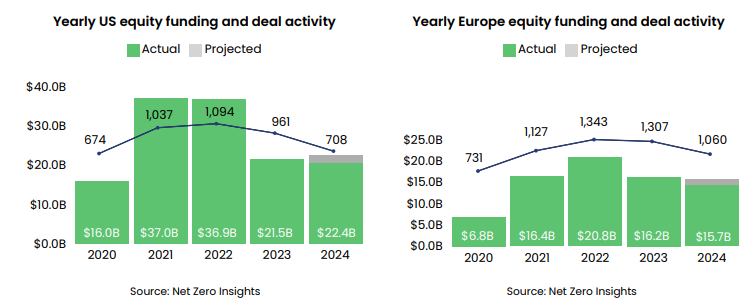

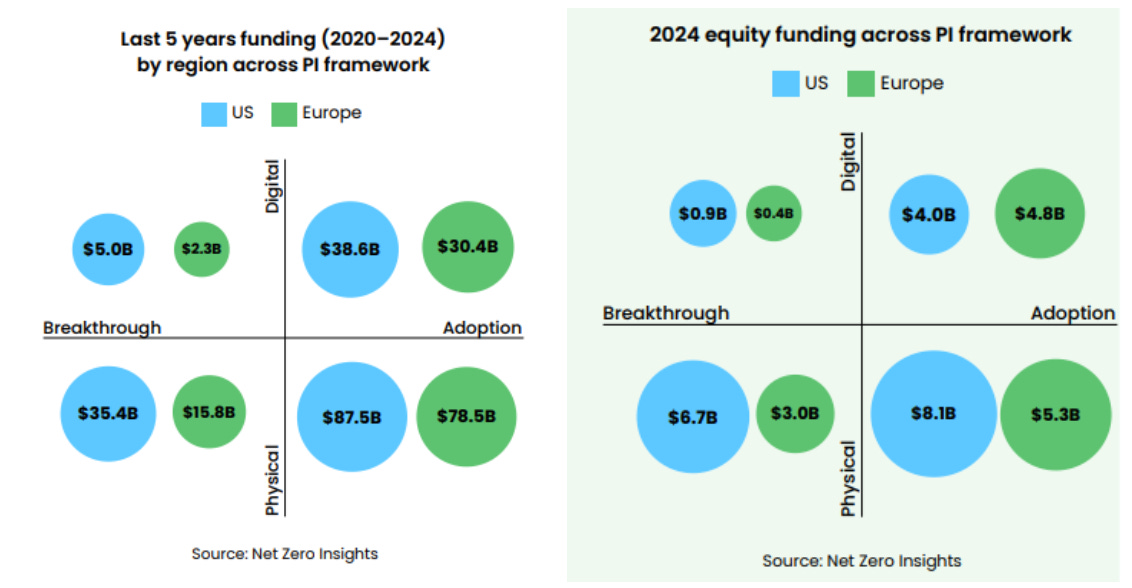

Regional highlights: Despite the drop overall for equity funding, equity funding in both the US and Europe was flat on last year (the global drop was driven by a fall in China and India).

Breakthrough vs Adoption tech: The US continues to be a better funder of breakthrough technologies, where debt is a much less relevant part of the capital stack.

The US last year also invested significantly more equity into physical adoption solutions, even though Europe was by far and away the bigger provider of debt (again, Northvolt being the outlier and maybe throwing into question how ready it was for a huge amount of debt).

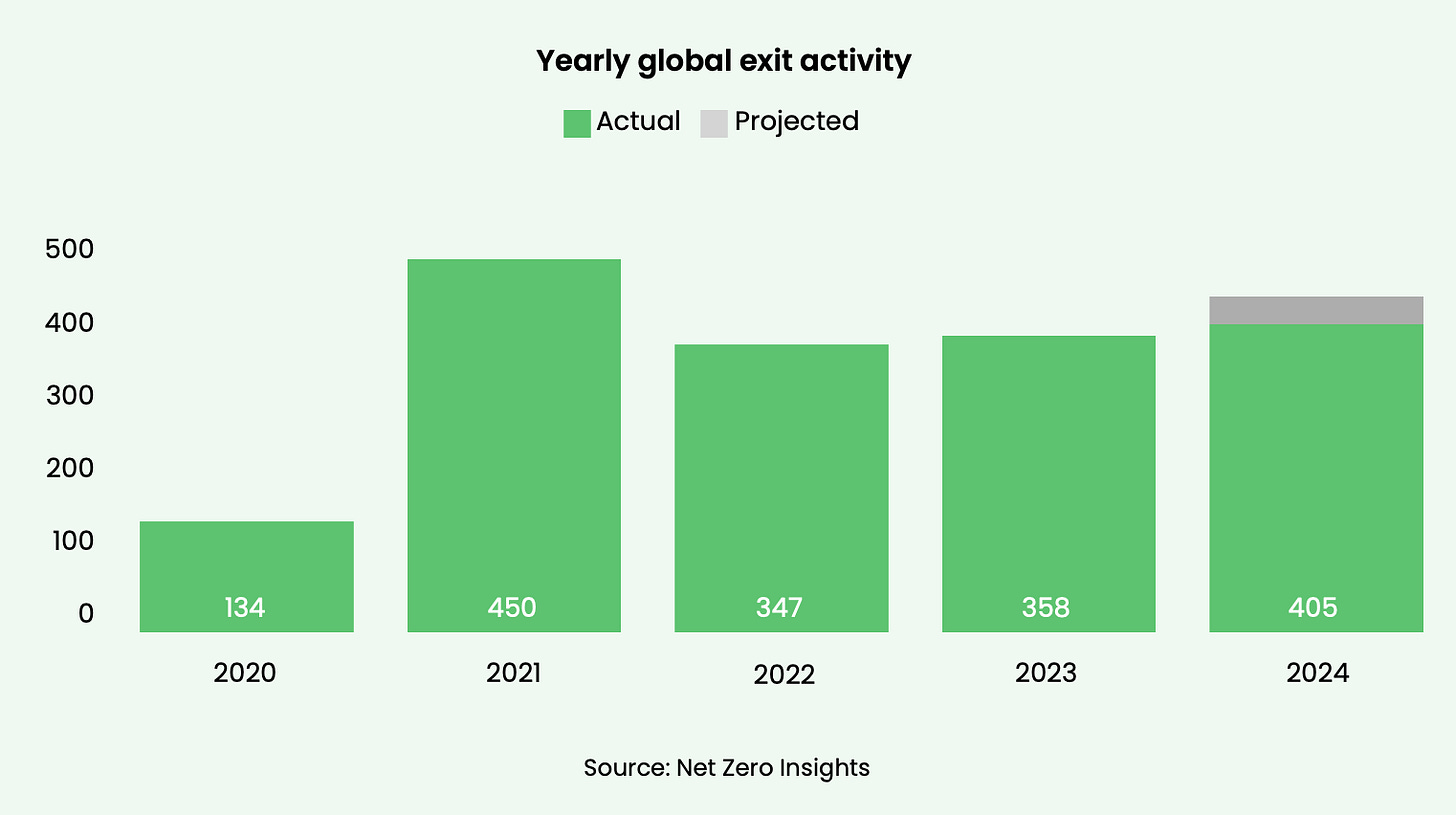

Exits: Although it didn’t feel like it, 2024 actually saw a rebound in the exit activity.

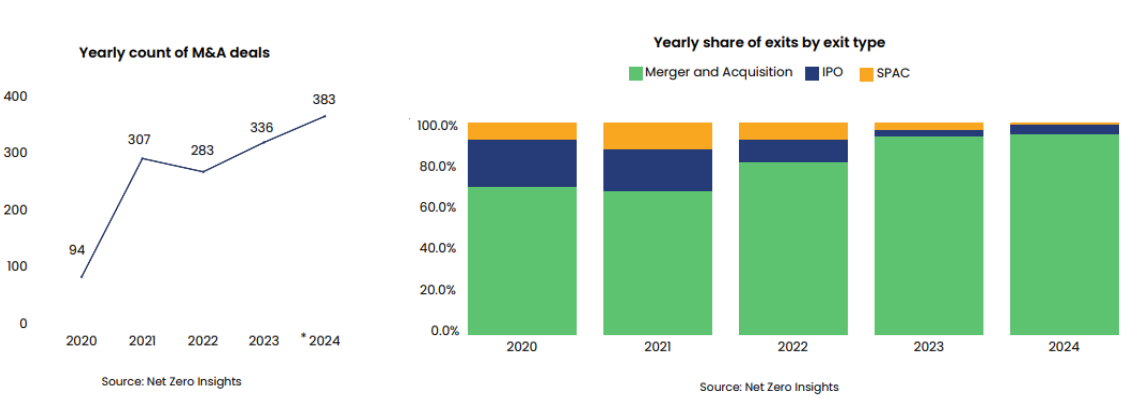

Driven by M&A: As across all sectors, the IPO market was moribund, with nearly all of the exits occurring through M&A and the vast majority of those (84%) from strategic rather than financial buyers. The good news is that activity there is increasing, with 60% of corporates surveyed by NZI saying they intended to increase M&A activity over the next 2-3 years.

But only small outcomes: Probably the reason that 2024 didn’t feel like a good exit year, despite the increase in number of transactions, is that there was a conspicuous lack of sizeable, landmark exits. If we look at the “most notable” exits cited by NZI for 2024, OLA Electric’s IPO at c. $4bn valuation (the $730mm mentioned below was fresh capital raised) was really the only big venture outcome. The acquisition of Environmental Solutions Group probably pushes the definition of “climate tech”, being a fairly staid, mature business serving the waste management sector. Ditto the Singaporean waste management company. And Owyn is a nutrition drink company, again stretching the definition of “climate tech”.

A couple of thoughts on this:

The climate tech space needs a spate of large (i.e. multi-billion dollar) exits over the next 2-3 years to demonstrate to generalist investors that meaningful amount of capital can be deployed and returned to investors.

Early stage climate VCs can’t depend on large exits to make their portfolio math work - there needs to be a viable path to returning healthy multiples to investors based on exits in the $100-500mm range.

We are encouraged that we are now seeing later stage climate companies generating serious revenue, which should position them well for when the IPO market returns to more normal operations. Further, it is widely expected that M&A activity will increase generally with the change of administration in the US and a looser approach to antitrust with the FTC. We are keenly watching!