Copper is often referred to as the “metal of electrification”, essential to the energy transition (as well as many other things), yet facing a drastic shortfall unless we do something about it. So do something we must! Here I’m going to get into the supply and demand dynamics, including energy transition-specific uses, as well as touching on some of the innovation coming to market in the industry. Despite all the press about the ramp in lithium demand for batteries, it is actually copper that has a much more drastic undersupply issue and, unlike lithium, needs to ramp up an already scaled, mature industry. To quote the S&P Report The Future of Copper from last year:

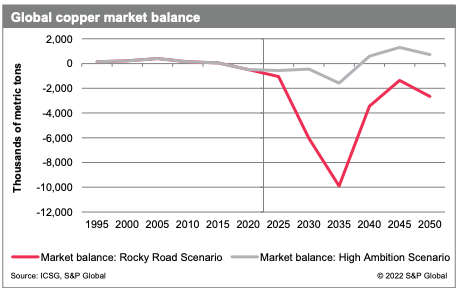

The potential supply-demand gap will be very large as the transition proceeds. Copper supply shortfalls begin in 2025 and last through most of the following decade. Substitution and recycling will not be enough to meet the demands of EVs, power infrastructure, and renewable generation. The goal of Net-Zero Emissions by 2050 will be short-circuited and remain out of reach unless massive new supply comes online in a timely way.

I suspect that copper will be one of those classic cases, where, from current vantage point, researchers say “along current trends” we will be undersupplied, but, in reality, underestimate the impact of innovation and humanity’s capacity to solve problems when we put our mind to it. The timing of this post has been somewhat prompted by content released around Ceibo’s recent $30mm series B, including this Catalyst episode and the recent CTVC interview with the CEO. I also recommend this MCJ episode with the CEO of MineSense and the full S&P report linked above for anyone who really wants to get into it.

What is the state of the copper industry today?

Supply:

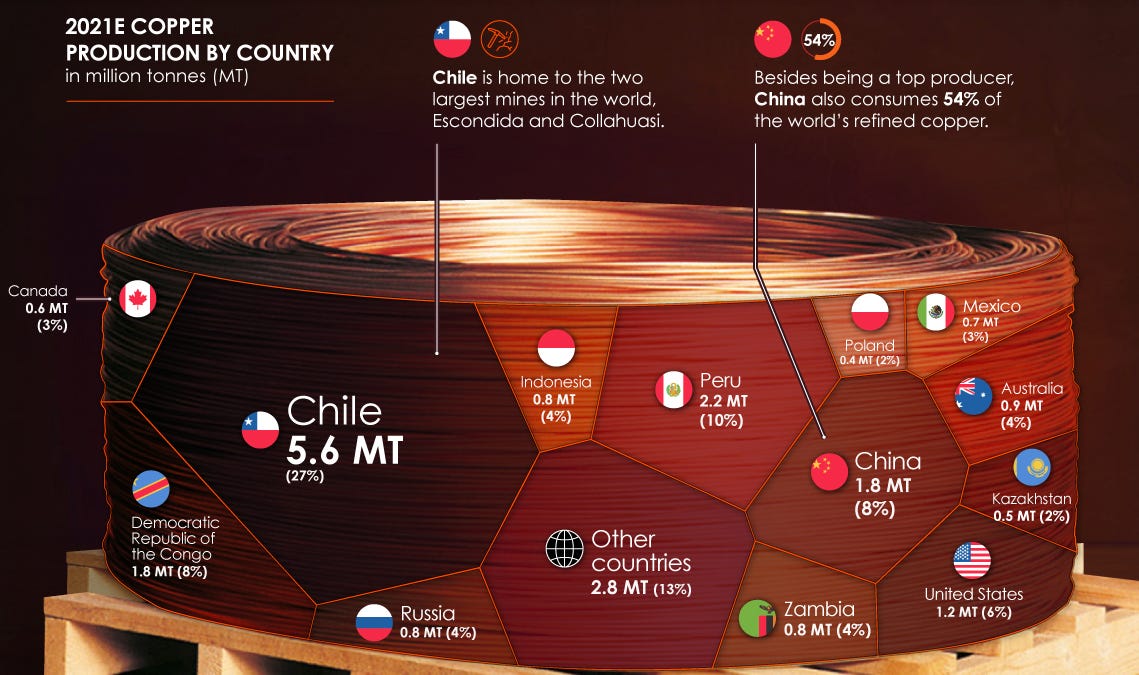

Chile is by far the largest primary producer of copper at a little less than 30%, followed by Peru with 10% market share. About 20% of refined copper is obtained from recycling.

The copper industry is concentrated in a few large players - Codelco (the Chilean state copper mining company) and Freeport McMoRan are the two largest players, followed by other large mining companies, BHP, Vale, etc.

The biggest single mine produces just over 1mm tonnes per year, with the second biggest at 600k tonnes, both in Chile.

Copper ore can either be in the form of oxides or sulphides. The former tend to be closer to the surface and higher grade. Today only about 20% of the world’s copper comes from oxides, with the rest coming from sulphides. (Side note: sulphides, sulphites and sulphates are all different forms of sulphur containing molecules - I had to look that up!) Indeed the quality of the resources has dropped significantly, falling from something like 4-6% copper content at the beginning of the industry 100 years ago, to 1.2% about 20 years ago and more like 0.5% today.

Demand:

We use approximately 25 million metric tonnes (MMT) of copper per year. The biggest use of copper is in construction, and it is also used in things like manufacturing planes, ships and cars, for things like piping and wiring. It is already used extensively in electricity networks for distribution (the movement of electricity at a more local level) and underground and undersea transmission cables (aluminium is used for high-voltage overhead transmission as it’s much lighter, as well as cheaper). Electricity lines already account for 20% of today’s copper use.

Unsurprisingly, China is by far the biggest consumer of copper, representing slightly more than half of global demand. They also have a substantial chunk of global smelting and refining capacity.

Demand outlook and energy transition:

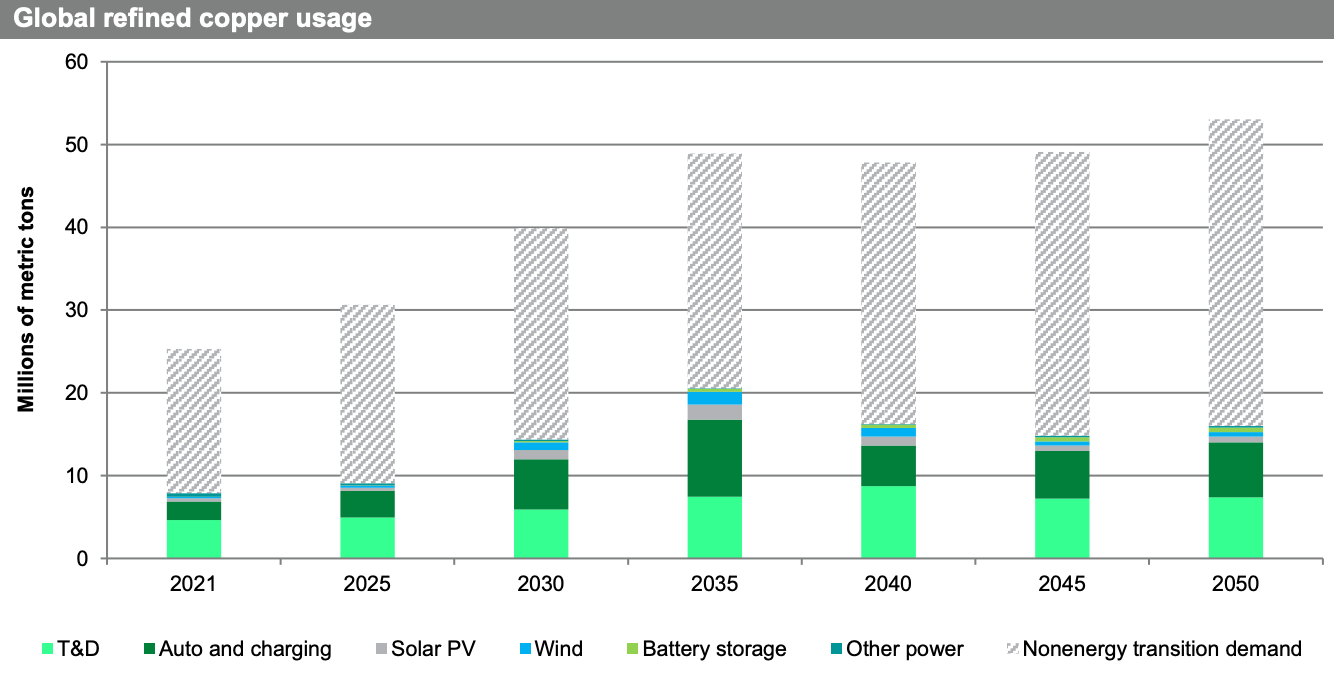

Demand would continue to rise for general use to the tune of 2% per year, even without the energy transition.

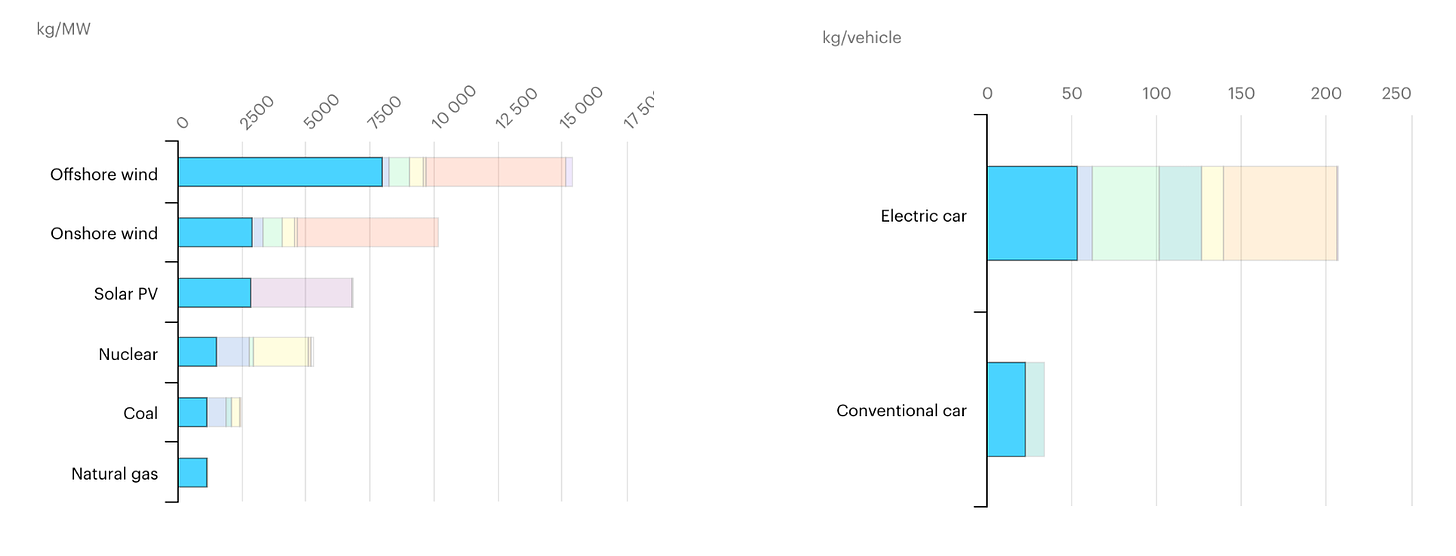

However, the energy transition represents a huge new source of demand for copper because of its widespread use in clean energy technologies. This is pretty much across the board:

Whilst clean electricity generation technologies do proportionally require more copper and do contribute to demand growth, the biggest driver by far of demand growth is EVs and charging infrastructure:

Overall, copper demand from clean energy including the grid is expected to rise from about 20% to 45% of total copper use and increase in absolute terms to the tune of 10-15 MMT over the next 15-20 years and (the equivalent of ~30 new major mines). Unfortunately, given the lead time for mines (see below), we pretty much know for certain that we are not going to be able to open enough mines, which means we are going to have to use technology to get much more out of the existing mines. The S&P report suggests we’re likely to have a shortfall either way, but it could be a shortfall of as much as 10 MMT or as little as 1.6 MMT, depending on how effectively new methods are implemented.

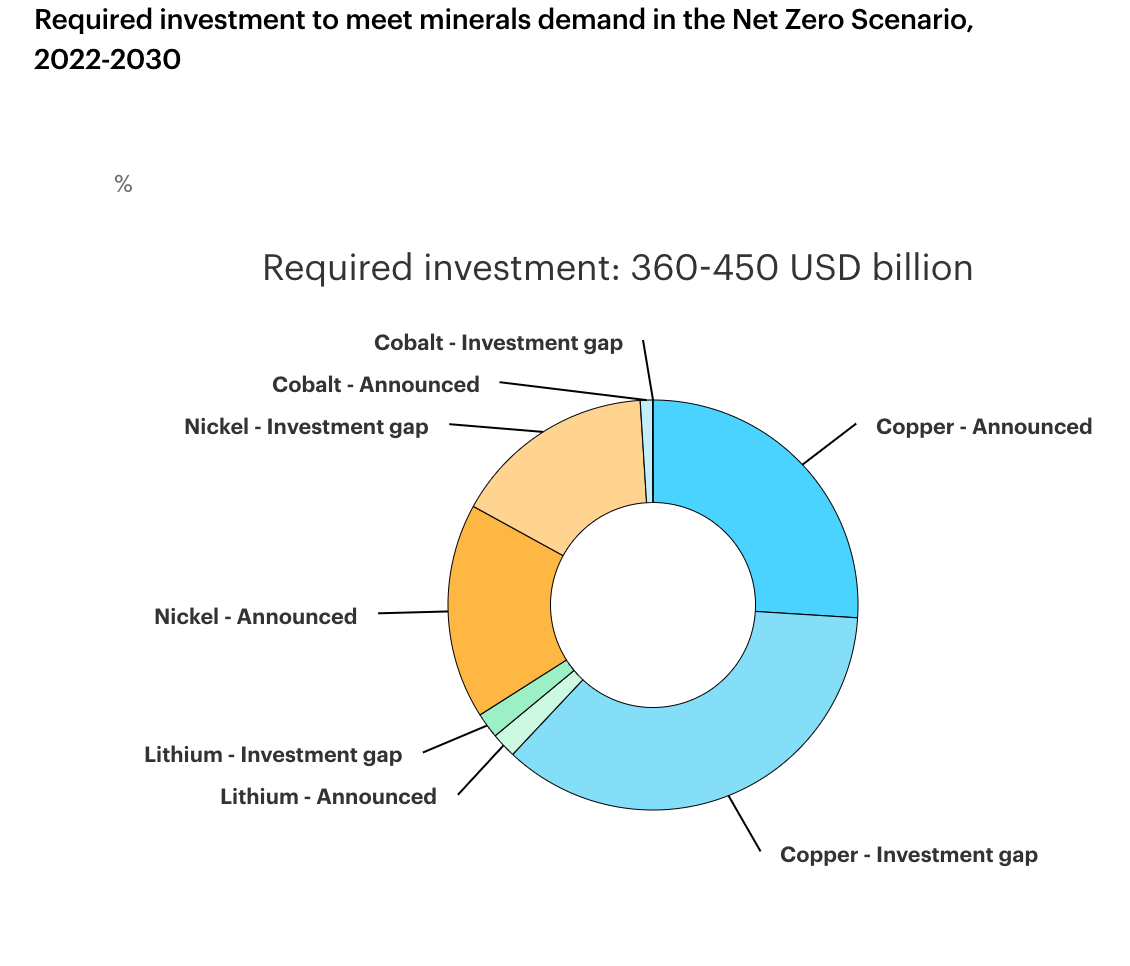

Whilst much is made of rise in demand for lithium and cobalt, the investment gap for copper as estimated by the IEA dwarfs that of either.

How Copper mining works:

Mine development: Generally it takes about 15-20 years end to end from early development to commissioning. It begins with light geological sampling and the acquisition of the mineral rights. This then moves onto pre-feasibility, and feasibility studies, during which the resource is more fully scoped and onto permitting and actual construction. The early stages of this process are generally done by the “junior” mining companies, doing the exploration work with smaller capital requirements. The mines are then generally sold to the “majors” who take on the late-stage, capex-heavy development.

When work begins on a mine, there is a lot of rock to move out of the way just to get at the ore. And even when you are at the ore, it isn’t clear when you are digging rock vs ore, can’t see it visually. Traditionally, mine operators continue to sample, send the samples to a lab to determine the quality of ore, and then they interpolate the ore quality between sample cores, but in reality don’t know what the quality is.

Given that 3% of world’s electricity use is consumed by crushing rocks, it’s important both from a sustainability and profitability perspective to maximise the amount of ore vs worthless rock that is crushed. This is where MineSense’s technology comes in, allowing mine operators to determine the quality of ore on a shovel by shovel basis. They can set a cut off line in terms of quality, above which it is worth processing, and below which it isn’t economical. MineSense has a ruggedised spectrometer that analyses the makeup of each shovel as it goes into the truck, and then tells the truck whether to go to bring the load to processing or waste.

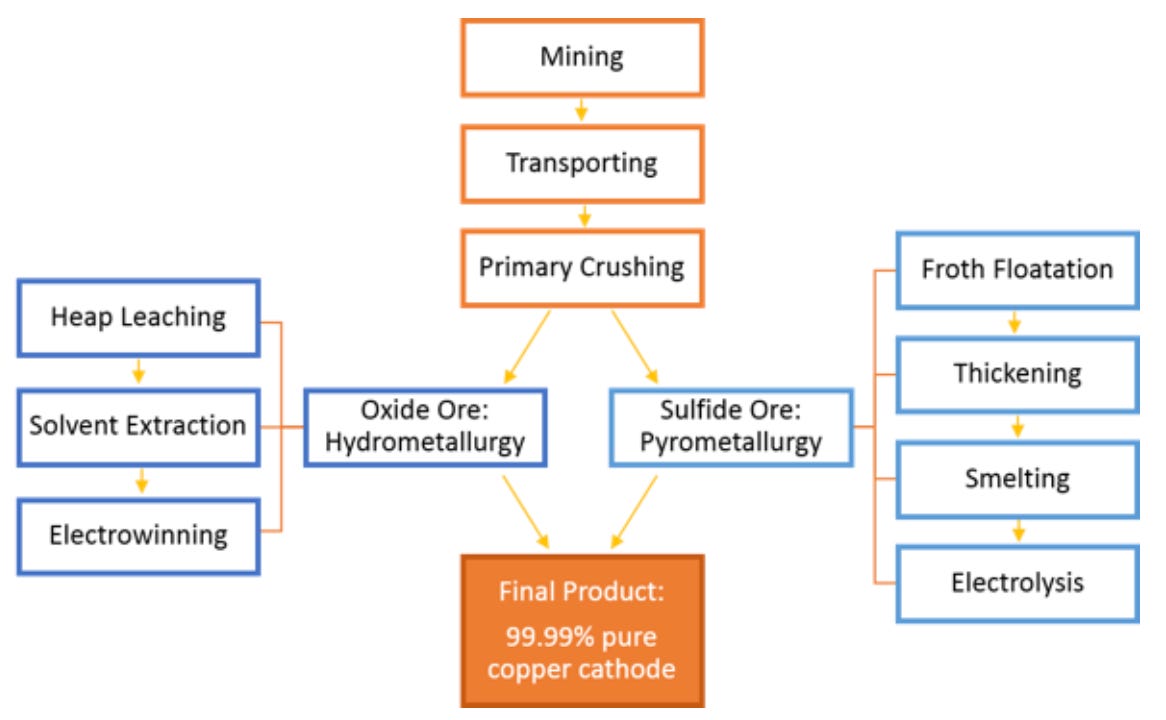

Once the ore has been collected it is processed in one of two ways, depending on whether it is a copper oxide or copper sulphide. If it is copper oxide, copper can be extracted by leaching (hydrometalurgic process) or concentration. Leaching involves irrigating the crushed rocks with a chemical solution that creates a liquor solution rich in copper ions. These are then separated via electrolysis to create a copper plate in a process called electrowinning. Copper sulphides traditionally can’t be processed using hydrometalurgy because of an inhibitive layer (“passivation layer”) that prevents effective leaching. These then are processed using concentration, where the crushed rocks are milled to fine powder and float the particles that are rich in copper, with the aim of bringing up a very low ore concentrate up to 30% copper. This process also creates waste water that is contained in tailing ponds. The copper concentrate is then moved to a smelter where it is further refined and made into copper bars.

Concentration is a very energy- and capital-intensive process. The oxide ores are generally used up first, so mine operators then have to make a decision whether or not to invest billions of dollars in the infrastructure for concentration to be able to process the sulphides, in particular chalcopyrite (copper iron sulphide), which represents about 70% of copper resources.

This is a major bottleneck to ramping production. Luckily, there are two prominent companies which are innovating on the leaching technology to allow sulphides to be extracted via hydrometallurgy. These are Ceibo (mentioned in the introduction) and Jetti Resources, who raised a $100mm Series D last year led by T Rowe Price and subsequently received an investment from BMW. This is definitely a space to watch!

Is there a good alternative to copper for conducting electricity? Is there any prospect for inventing a new alternative?