The tide is mercifully going out on the much hyped notion of a future “hydrogen economy”, where the magical molecule will run everything from cars to industry to home heating. Bit by bit, electrification has been taking territory from areas that had once been considered ripe for hydrogenification, like trucking, trains and industrial heat. As I was giving more thought to the viable opportunities areas for different production technologies of low-carbon hydrogen, we were treated to a deep dive on the topic by Evok Innovations, where we are very happy investors at Keeling Capital. With their permission, I’m sharing here some of the key insights from that presentation and some of my own thoughts about where this might be going.

Current state of play - market size, uses, production:

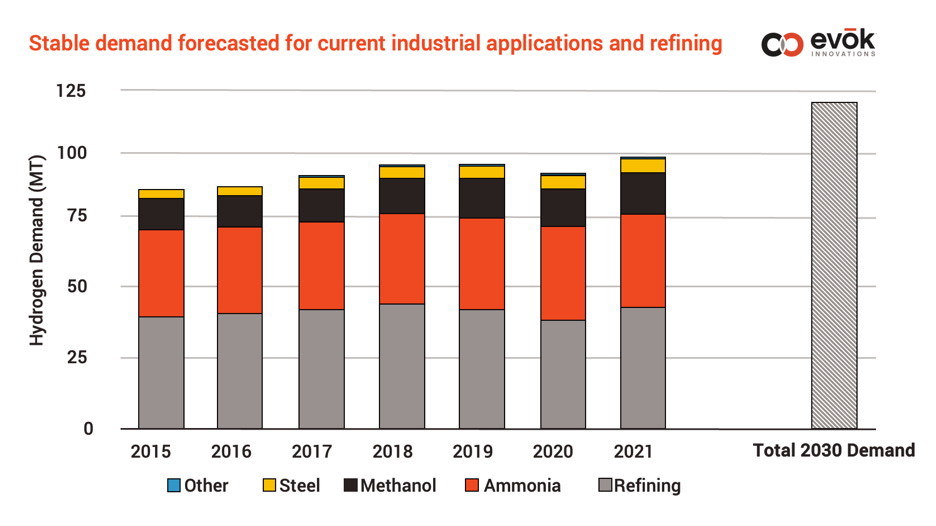

The existing hydrogen market is a bit less than 100mm tonnes / year.

Of this, a bit less than half is used for refining, and a decent chunk of that is created as a byproduct of the refining process and is recycled back, so that leaves something in the order of 80mm tonnes of dedicated hydrogen production globally.

The other half is used for ammonia (which is mostly used for fertilisers) and methanol (a precursor chemical and, in China, a fuel).

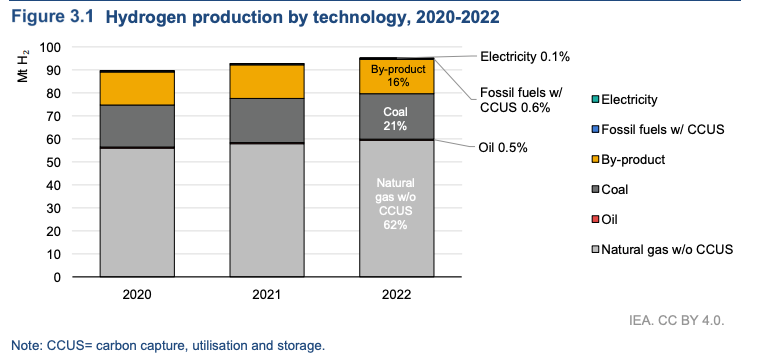

Today, very nearly 100% of hydrogen is produced from fossil fuels, with no carbon capture, resulting in a nearly 1 GIGATON abatement opportunity. This is BEFORE ANY ADDITIONAL USES OF HYDROGEN!

For all the fanfare of green hydrogen via electrolysis, you can’t even see the 0.1% sliver in the below chart. The pipeline of announced low-emission hydrogen projects is significant, totalling 38mm tonnes, but only 4% of those (2mm tonnes) have reached final investment decision.

Potential future uses:

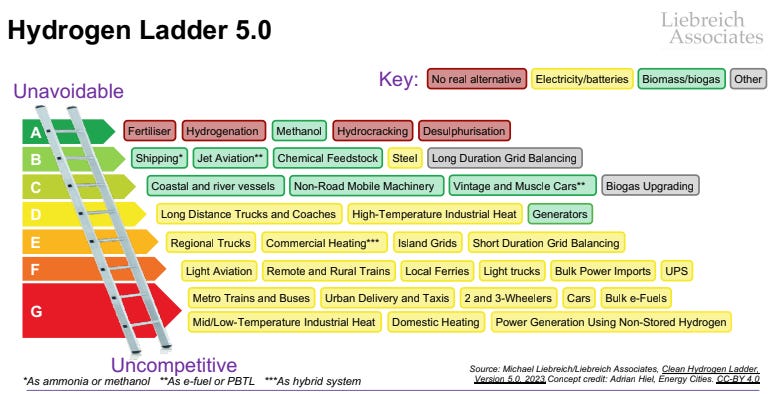

Let us refer back to the ubiquitous and indispensable Hydrogen Ladder from Michael Liebreich:

As you can see, nearly the entire top rung of the Ladder are existing uses, where the value of hydrogen is as a molecule, and not as an energy carrier. With only a few exceptions, the potential uses of hydrogen as an energy carrier occupy rows D through G - all of which are more tractable with electricity / batteries.

That said, there is still almost 100mm tonnes of high-emitting hydrogen for existing uses that we’d like to replace with low-carbon hydrogen, and reasonable upside for things like green methanol or ammonia for shipping, maybe, maybe not SAF and long duration grid storage. How do we go about it?

Low-emission production methods:

We can ignore the hydrogen rainbow (grey, blue, green, turquoise, pink, gold, white) and just focus on the key feature - low-emission. There are a number of pathways:

Steam methane reforming (SMR) with carbon capture: SMR is how most of the world’s hydrogen is currently produced. It has the unfortunate side effect of producing a lot of carbon dioxide (chemical path CH4 + 2H2O -> 4H2 + CO2). If that could be effectively captured and fugitive methane emissions reduced, it could be low-emission.

Electrolysis: where most of the attention, money and hype has gone, using electricity to split water (2H2O -> 2H2 + O2).

Methane pyrolysis: Using the same feedstock as SMR, but instead of getting out carbon in the form of carbon dioxide, it comes out in a solid carbon form. (CH4 → 2H2 + C)

Geological hydrogen: Producing hydrogen from naturally occurring subsurface reservoirs. (This is one of the most exciting new areas across the energy space as it could be a genuine new addition to the overall energy system and is an area where Keeling Capital has exposure through Evok’s port co, Koloma, who raised a $245mm series B earlier this year.)

These methods with their various inputs and outputs are brilliantly summarised by this slide:

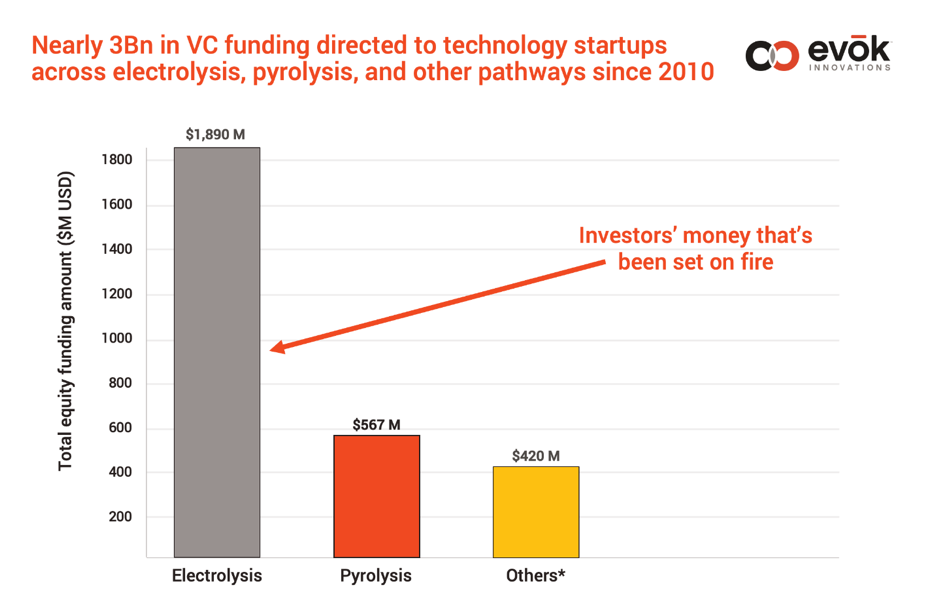

As noted, there has been plenty of hype around hydrogen and there has been a fair amount of VC dollars that have gone into different technology solutions. We’ll be coming back to this chart.

Transport:

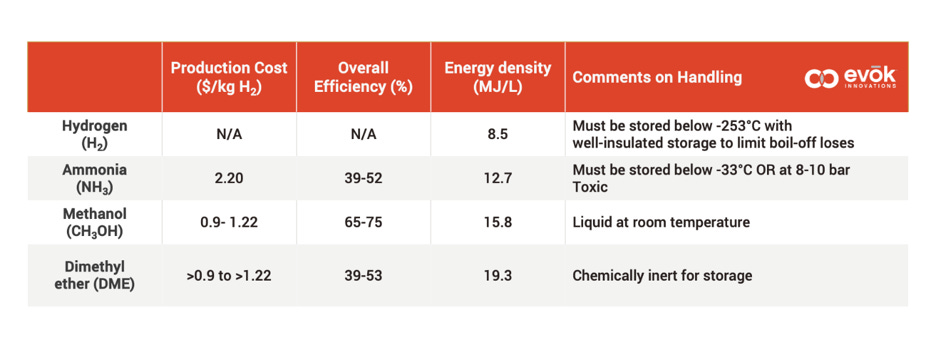

A very important constraint on the development of projects and in understanding the niches that different production methods will fill is the difficulty of transporting hydrogen. Today, the vast majority of hydrogen is consumed where it is produced. The main challenge of transporting it is that it has very low volumetric density (energy per unit volume), so it is totally economically infeasible to transport by ship and it reduces the energy content where blended with natural gas in existing gas pipelines, actually to such an extent that, to quote Evok’s presentation, “you could have negligible reductions, or even greater emissions by blending hydrogen into existing natural gas networks”. It could be done with dedicated pipelines (indeed these already exist), but it is somewhat challenging as hydrogen escapes and embrittles steel, as well as requiring new dedicated infrastructure with permitting etc.

There are various intermediates that can improve the portability, but all of them incur greater cost and conversion losses. From the Evok presentation:

On the whole area of the challenges of transporting hydrogen, I’d recommend Michael Liebreich’s essay, The Unbearable Lightness of Hydrogen.

Electrolysis:

By far the most VC dollars have gone into electrolyser companies. Let’s unpack the prospects for low-carbon H2 through electrolysis and the role it might play. Europe in particular is very keen on hydrogen; hydrogen in general, but with a particular fascination for hydrogen through electrolysis powered by wind and solar, or what they define as “renewable hydrogen” (can also be biomass processing, but that’s not emphasised). The EU has a target to produce 10mm tonnes of renewable hydrogen by 2030, with new renewable electricity capacity or “excess” renewables that would otherwise be curtailed.

Framing power requirements:

Take Evok’s number rounded to 40 MWh per tonne of H2. To make 10mm tonnes via electrolysis would require 400 TWh of electricity.

Using numbers from Ember’s European Electricity Review, last year Europe produced 721 TWh of electricity from wind and solar. (It also produced 936 TWh from nuclear and hydro, but it isn’t rapidly building more of either, not yet.)

Assuming roughly the same capacity factor, the hydrogen targets would require a bit over half again as much renewable capacity as Europe has already.

Europe also still produced 870 TWh of electricity from fossil fuels, 333 TWh of which was coal.

Wind and solar production in Europe increased by 91 TWh last year.

So actually, creating an additional ~700 TWh of clean power through wind and solar by the end of the decade to replace coal and power electrolysers for 10mm tonnes isn’t totally outlandish.

Which electrolysers?

The cost of hydrogen (and actually most energy infrastructure) is determined by three things - cost of inputs (electricity in the case of electrolysis), the capex, and the capacity factor (% of uptime, determining how much your capex is spread over units of production). The idea of using renewables in general, and curtailed renewables in particular, is that you can reduce the cost of the first item on that list - input cost. The challenge with using wind and solar to power electrolysers is that the electrolysers need to have some flexibility to ramp up and down. That creates issues with the other two determinants of cost. Firstly, the type of electrolysers that are better suited to ramping up and down, “PEM” (standing for either proton-exchange membrane, or polymer electrolyte membrane) electrolysers, are more expensive and contain rare metals, so the capex is higher. Secondly, if they are only running on renewables, they will have a lower capacity factor, so that higher capex will be amortised over a smaller number of operating hours. You can run it with higher capacity factor using back up from the grid, but only when there isn’t high generation from renewables, which will increase the carbon intensity, unless you’re in France or Sweden with a lot of nuclear or hydro.

China: I’ve said it before and I’ll say it again:

China is already way ahead in installed electrolyser capacity and has reached that lead rapidly. According to the IEA’s most recent Global Hydrogen Review, China had gone from less than 10% of the world’s installed capacity in 2020 to over 50% last year at 1.2GW, including the world’s largest single project at 260MW, and have been continuing to announce massive new projects related to renewable methanol detailed in TP Huang’s recent post on the topic.

On manufacturing capacity, China is BY FAR the lowest cost producer at comparable quality; BNEF puts them at about 25% of the cost of European producers. This Linkedin post from the CTO of TES (a e-methane developer) speaks volumes:

“The prices and design of their pre-engineered, pre-fabricated modular systems in the 5-20MW range are allowing to minimize engineering and construction scope in the West - something that causes total system CAPEX to be 3-4 times stack price here while complete package from China including on-site construction and remaining engineering will come in at less than half total costs.”

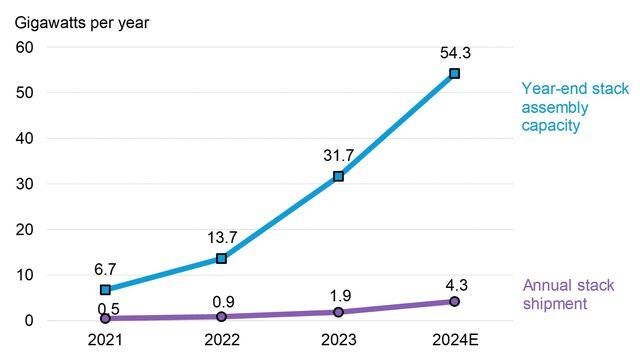

Overcapacity: Bloomberg New Energy Finance (BNEF) estimated electrolyser manufacturing capacity at 31GW last year vs a market size of 2GW, only to be exacerbated if the announced factories come into operation this year.

This, it should go without saying, has ominous echoes from a previous era, where China swooped in to capture nearly the entire global market in solar PV manufacturing. Just like that dynamic, this will be a good thing for those trying to cobble together economically viable hydrogen electrolysis projects, who can avail of the lower costs, and very bad for Western manufacturers. There could be some sliver of hope through geopolitical concerns, but this, imho, is the most likely outcome (my words, not the Evok team’s):

Methane Pyrolysis:

The major benefit of methane pyrolysis - and it is MAJOR - is that it utilises the existing distribution infrastructure of the natural gas network. We know for a fact that current users of hydrogen - for those uses at the top of the ladder - already have a natural gas connection because they are already using it to produce hydrogen through SMR. Whilst heat is further down the ladder, you could also potentially see a route to converting natural gas to hydrogen for heat. It would be more expensive than using the nat gas directly, but doesn’t seem totally ludicrous like using hydrogen from electrolysis would be as the energy requirement is about 1/8th.

Hydrogen or Carbon? One of the insights from the Evok presentation was that with any given methane pyrolysis tech, it can be optimised for either production of hydrogen or some form of marketable solid carbon output (carbon black, synthetic graphite, carbon nanotubes, etc), but not both. So if you come across a company telling you they’ll be selling top shelf carbon black, plus a load of hydrogen, approach with caution.

Geological hydrogen:

As mentioned above, this is one of the most exciting areas for potential low-carbon hydrogen production because it doesn’t require that we use existing sources of energy to develop and it is likely to exist at massive scale and potentially super cheaply at <$1 / kg. The Economist had a good article on it in last year’s Christmas special for those interested.

The significant hurdle to be overcome, assuming that companies like Koloma can work out how to economically extract it, is that, although resources are reasonably geographically distributed, geological hydrogen is not likely to be adjacent to sites for industrial consumption. That requires either pipelines to be built, or for new users to co-locate new facilities with hydrogen resources. Whilst this would represent a significant investment, both seem plausible. Hydrogen pipelines do exist and we already have examples of industries co-locating where they can get access to cheap / low carbon energy sources, e.g. H2GreenSteel in Northern Sweden (hydro), aluminium smelting in Iceland (hydro).

Conclusions:

My overall best guesses on the direction of the hydrogen market, sharpened up significantly by Evok’s deep dive, are as follows:

The urgent task of displacing high-emitting hydrogen for existing uses in chemicals, fertilisers, and refining is best suited to methane pyrolysis, which reuses the existing infrastructure of the gas distribution network that these facilities are already plugged into. Again, existing uses of hydrogen represent almost a 1GT CO2 abatement challenge/opportunity.

New uses of hydrogen, those at or near the top of the Ladder, will occur in specific parts of the world with the industrial users mostly co-located or hydrogen converted into a chemical carrier, like ammonia or methanol.

These could be through electrolysis in areas of abundant renewable resources - Chile, Australia, Saudi Arabia, etc - which will be driven by Chinese electrolysers, as well as, most likely, being powered by Chinese solar panels. Western electrolyser manufacturers aren’t likely to be very successful as the levels of on-going subsidies required to be competitive will likely be challenging for Western governments with budget constraints, as well as a generally poor use of tax payers’ money.

These new projects could also be located near areas with geological hydrogen resources, which might actually be able to produce hydrogen cheaply enough that it makes sense to use it as an energy carrier, mostly green ammonia or methanol for shipping or for SAF.

It will take a bit of time for this to play out, but I suspect that we’ll have much more certainty on the winning platform technologies and the general shape of the hydrogen industry within the next 3-5 years as some of the more nascent technologies become proven out.

Are there any specific problems in hydrogen production caused by bacterial biofilm? Biofilm clogs filters and pipes in most industrial processes using water.