Following from last week’s Notes on decarbonising the grid, I’m spending a bit more time dwelling on what the future of the energy grid might look like. The two biggest levers of decarbonisation are 1. Decarbonise electricity and 2. Electrify everything. The grid of the future therefore has its work cut out for it. Already we have gone well beyond what was originally thought possible in terms of flexibility - early in the days of renewables, it was estimated that the grid would tap out at 3% or 5% penetration of variable resources like wind and solar. As the variability of generation increases at the same time that demand applications proliferate, the grid will require increased flexibility. This is really where distributed energy resources (DERs) come in, through storage, demand-side-response and generation. But making millions of devices sing together is challenging. The opportunity to become the conductor of this orchestra is an obvious one and there are lots of companies now applying themselves to it (Thunder Said Energy just profiled 40 different companies in the space). For this Notes, I tuned into the always-excellent Catalyst podcast, for a conversation with Astrid Atkinson, CEO and founder of Camus Energy. Other prominent companies in the space include Auto-Grid, Octopus Energy and Arcadia.

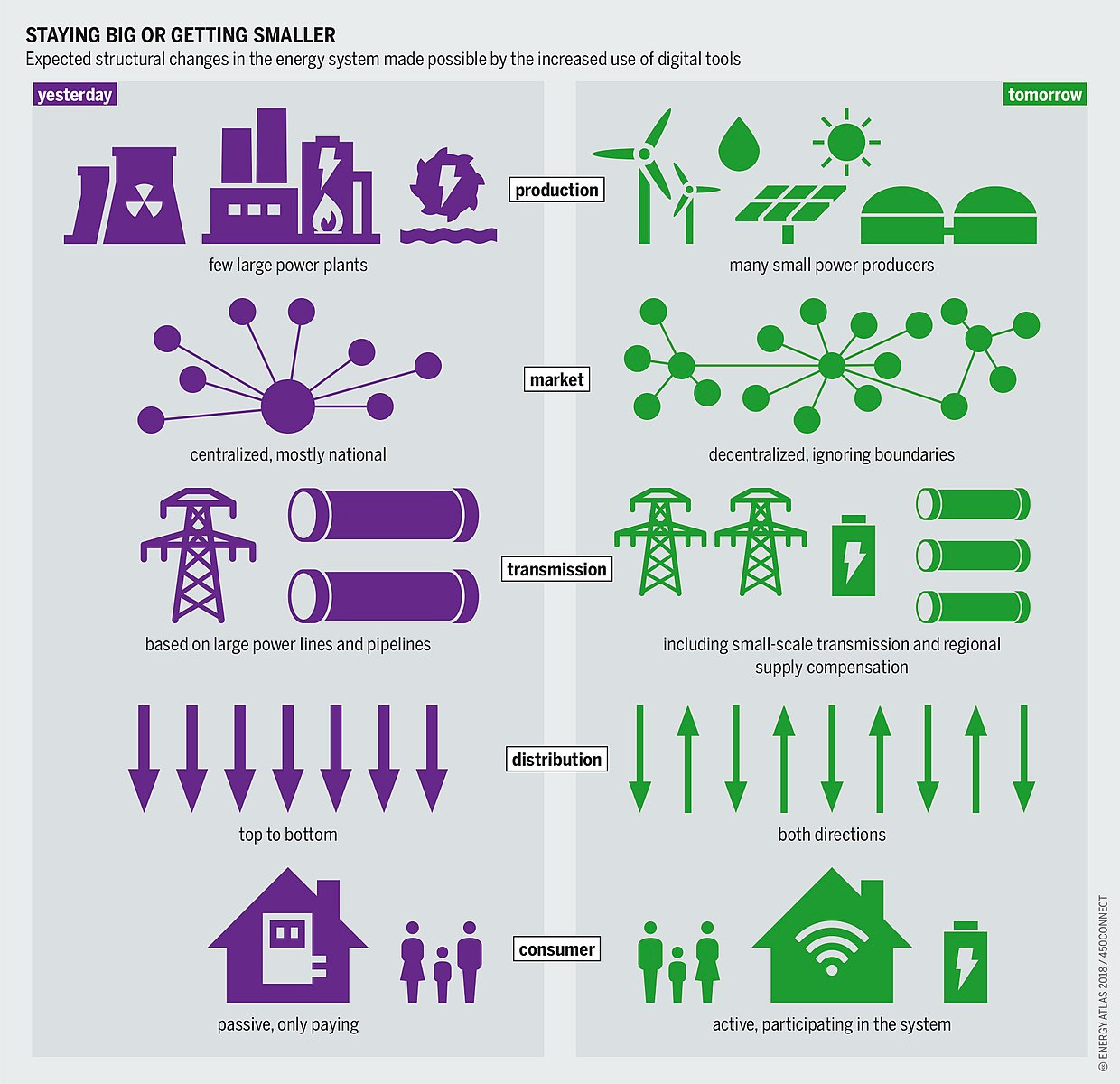

We are shifting from a world of large centralised generation to one with lots of resources on the edge of the grid, known as Distributed Energy Resources (DERs), like so:

Image: Energy Atlas

What types of devices falls into DERs?

Rooftop solar

Battery

EVs

Consumer devices - dynamically adjustable thermostats / heaters

Commercial & Industrial - commercial fridges, industrial heat, etc (controllable customer resources)

DERs scaling has mostly been driven by economics, but there has been a huge increase in demand due to concerns around resilience - there are now long wait times for home battery systems in California and Texas after power outages.

Up till now, DERs have struggled to fulfil their promise of allowing owners to get compensated by way of integrating them into the grid and getting paid for grid services.

Utilities are not well equipped to deal with very high penetration of DERs. For example, Hawaii has high penetration of rooftop solar both because it is sunny and because energy prices are high. We’re now seeing the utility there start to push back on more installations because of challenges of managing the grid.

Where are we on data collection? Transmission infrastructure now has good data on what is happening on the grid at sub-station level, but the distribution systems (i.e. where the electricity goes to end-users at lower voltage) have generally very poor. They’ll have data at the substation level (the interface between transmission and distribution systems), but each substation could serve 100,000 customers, where the utility will have no visibility. The best case, with smart meters installed, they’ll have data at 15 minute intervals and will only get the data on a delayed basis.

Camus has had to start by building the infrastructure of collecting the data, a prerequisite for developing the software for resource management.

Cloud computing enables much more powerful handling of data - previously utilities would use proprietary, on-site servers - orders of magnitude less powerful than using cloud computing infrastructure from the big tech companies.

Key enablers for greater DER integration:

Net metering - incentive structure that will allow people to put energy back onto the grid - but this lever is limited to generation like rooftop solar, not to demand side

Demand response - just starting to see it being introduced by a few utilities in automated ways that allow greater adoption (previously demand response only with very large customers, where the grid would call them on the phone to turn down usage)

Standardisation - lots of different regulatory conditions across states as well as nations

For wider adoption also need to tap into the DERs at the manufacturer or installer level - much easier to drive change with a few leverage points rather than signing up end-users individually.

With regulation there are also some leverage points in the system. There are 7 transmission system operators (TSOs) in the US that set rules for how energy services can be used within their territories. The new(ish) FERC ruling 2222 says that DERs should be able to participate in the wholesale market, which sets the direction for the TSOs.

Co-op utilities - out of 3000 utilities in the US, only 150 are investor-owned. The rest are public or co-operatives, mostly created during New Deal era. Co-ops are owned by members (i.e. customers) and will really try to reflect the values of members. So where co-op members care about decarbonisation, they can quickly push change. Co-ops leading the way in creating rapid decarbonisation.

Really successful large-scale change when bringing together the right coalition of partners and where it is possible to rapidly iterate things in the field within a safe framework.