The below is a note we shared late last week reflecting on implications of a new Trump presidency. I thought it could be of interest to my readers here.

What a week it has been! We wanted to send you a brief note following the decisive election victory from Trump and the broader Republican party during the week and the potential implications for clean energy and our investment thesis. We've tried (with only middling success) to keep this brief and condensed as there is an endless amount of commentary widely available online if you want to dig deeper.

Disclaimer: making predictions is hard, especially about the future, and especially about Donald Trump. Myself and Ross cut our teeth at investment banks and in financial markets, where sell-side economists - smart, experienced, and well resourced - would make confident predictions about the directions of various things, only to have them work out entirely differently. We can make some informed guesses here, but we'll know more in the coming months.

Punchline: Whilst there might be some short term volatility as the market gets clarity on any potential changes, the bulk of the IRA is unlikely to be rolled back and the large, consistent trends around the roll outs of clean energy, electric vehicles and batteries will persist. Some of the agencies - specifically the EPA and the DoE - are likely to be weakened, with less federal regulatory push on environmental standards and reduction of funds or redirection of focus for the DoE's Loan Programme Office and Office of Clean Energy Demonstration. These would create a harder path for capital intensive technologies that need the non-dilutive or concessionary government financing to ease the equity burden. There can still be environmental regulation at state levels, which happened under his first term.

Why is the IRA not at major risk? Unwinding it wholesale or substantially will require broad political approval. Red states have benefited from IRA-related investment over blue states by 4:1 ratio. Everyone likes the associated economic activity, including oil and gas companies. (Trump also has a very prominent ally that has substantial exposure to the EV market.) That said, the new administration might slow-walk some of the disbursals down to states, which then pay it to companies and consumers. IRA beneficiaries:

Clean energy didn't stall under Trump last time

The build out of wind and solar generation under the first Trump administration was significant. Solar has grown faster under Biden, but wind energy production actually grew faster under Trump. (That's unlikely to be repeated on the wind side given his vocal dislike of wind and the general permitting issues for wind.) Furthermore, 45Q - the carbon capture tax incentive - was a Trump era bill. It was augmented under the IRA, but it was originally signed into law by Trump.

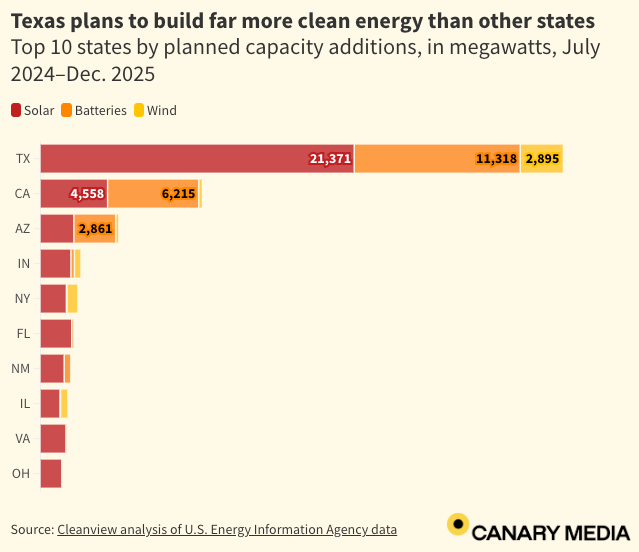

Also, the fastest growth in renewable energy generation BY A MILE is in the red state of Texas, showing just how much the economics have shifted as these technologies have matured:

Tariffs and trade

This isn't an area we have strong conviction on, but, talking to people who are smarter than us, the view is that supply chains have shown themselves to adapt to tariffs (including setting up US manufacturing) and they haven't historically slowed things down meaningfully. It was some comfort to hear Elon Musk talking sensibly about trade and tariffs recently. However, this is undoubtedly a risk area.

Adjustments to Keeling's thesis?

The change of administration doesn't substantially alter our thesis. We were never believers in a green premium - businesses need to provide a compelling economic case for their end customers. Whilst some of the more capital intensive, deep-tech stuff might suffer from a hobbled LPO, we've always drilled down on the equity intensity assumptions of managers investing in these types of businesses (i.e. At One Ventures and Evok Innovations) and their understanding of how to achieve equity-light scaling. But this election result will raise the bar for new investments in foundational-tech focussed managers.

The workhorse decarb technologies of solar, batteries, EVs will continue to grow and new opportunities to remove bottlenecks and serve these large and growing end markets will continue to arise. On balance, we might have slightly greater emphasis on managers focussed on enabling technologies.

We will continue to back the best managers out there. We still believe that these are mostly in North America, although many have the capacity to invest in European companies so the portfolio exposure will be more balanced across regions than the manager-HQ locations might suggest.

Portfolio exposure

Although early in the portfolio development, we have a large amount of sub-sector diversification in the underlying companies already:

Our largest single underlying position is in Koloma, in the geological hydrogen space. An expert that Evok Innovations hosted for a fireside chat recently on this topic suggested that low-carbon hydrogen through electrolysis is unpopular with Trump's faction, but that other forms (methane pyrolysis, geological) are much more favoured. This actually seems pretty sensible to us!

Metals and Minerals is the other large sector exposure. These companies do not seem exposed to risk from an administration change. The largest position is in MineSense, operating mostly in Chile. None of the companies require money from the DoE scaling programmes to succeed.

Looking through our list of underlying port cos, there aren't any that standout as at risk of being severely negatively impacted as some of the more capital intensive ones are outside the US - Europe or Canada. But, for sure, volatility is unwelcome as a general rule.

Closing

Any slowing of climate action is bad news, and a Trump win does not bode well for accelerated action domestically or globally, and will in fact be a drag in certain areas. However, the energy transition and the related industries have huge momentum, driven primarily by the hard economics, or superior performance of the technologies. These trends persisted all through Trump's first term with investments in energy transition globally more than doubling since then. We have never been believers in green premiums and now, more than ever, we need to be laser-focussed on technologies that have rock solid economic viability as well as climate impact.

We're going to be keeping our heads down and doing the work.

What do you believe is the reason for Texas dwarfing all other states in clean energy additions in 2024-25?