Liftoff Report: Innovative Grid Deployment

Critical unlock for economic growth and decarbonisation

The grid and transmission has been taking an ever more central place in the energy transition as the realities of variable renewable generation across and within regions have collided with increasing load growth (in the US) from increased manufacturing activity, data centre growth (both AI-related and other) and increasing electrification. Ultimately, to get a deeply decarbonised grid that is also reliable, we’ll need to build more nuclear and more long-distance transmission lines, and the more we can do of the latter the less we will need of the former. But both of those things take a long time to do, and time is not something that we have on our side. In the meantime, we need to find ways to get more out of the existing grid, to move more power and to increase flexibility, without needing to permit lots of new transmission lines. This is an important and complex area and the DoE did an amazing job with their most recent Liftoff report on Grid Innovations to bring it all together in one document. For those with the time and interest, the full report is well worth a read as it demystifies the complex operations of the grid, its rules and various stakeholders.

Before diving into the report, I’ll give a bit of context plus some updates on things that have happened in the couple of months since the report was released.

Investment: According to BNEF, the world spent $310bn on grids last year, which would need to more than double on an annual basis over the balance of the decade to be consistent with their Net Zero scenario. A recent Eurelectric report, Grids for Speed, suggests that investment in the lower voltage distribution grid in Europe needs to roughly double to around EUR 70bn per year, whilst Thunder Said Energy estimates that US decarbonisation would require grid investment to jump almost 4x by 2040.

Unlocking this capex is now the biggest risk to US decarbonization - Thunder Said Energy

And, indeed, companies are aggressively stepping up investment. National Grid announced it was doubling investment over the next five years compared to the previous, whilst Hitachi Energy just announced $4.5bn investment in grid infra capabilities over the next five years, more than doubling their rate of investment. The DoE report also notes that over 50 investor owned utilities have increased distribution grid investment more than 10x between 2018 and 2023.

Policy environment: The Department of Energy released a preliminary list of 10 National Interest Electric Transmission Corridors (NIETCs - pronounced “neat-seas”), 3,500 miles of priority transmission routes that would be eligible for federal financial support and streamlined permitting. Additionally, and extremely relevant for this DoE Liftoff report, the Federal Energy Regulatory Commission (FERC) approved a new rule that requires grid operators to create 20 year plans for grid investments, taking into account various reliability and economic outcomes. Going through this Liftoff report, the need for this integrated forward planning comes up again and again, so the FERC rule is a big deal.

Now for the report itself.

Why are grid innovations critical? There are rising demands on the grid both from increased variable generation and increasing demand, with estimates that grid capacity will need to double or more over the next 10 years. It is slow and expensive to build new transmission infrastructure, and it’s often unnecessary when there is more capacity that can be squeezed out of existing wires.

Additionally, the existing grid is old. From the report: Across the United States, there are over 642,000 miles of high voltage transmission, 6.3 million miles of distribution lines, and 55,000 substations that serve over 170 million residential, commercial, and industrial customers. The average age of U.S. grid infrastructure is 40 years, with an estimated 30% of transmission lines needing to be replaced in the next decade and over 60% of distribution lines operating near or beyond their useful life.

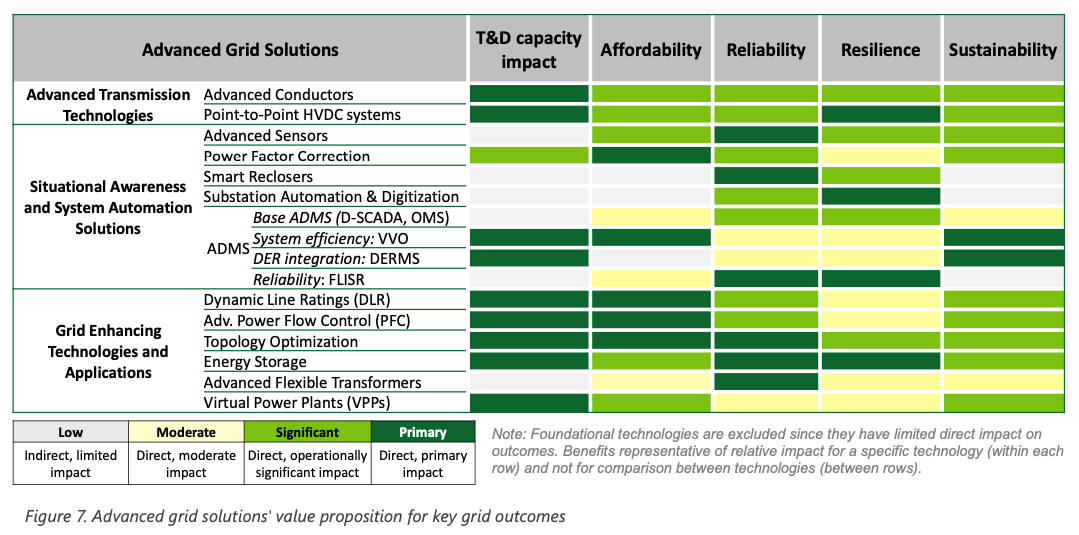

Grid Innovation categories: The DoE breaks these down into four groups, which collectively include 20 underlying technologies (for reference these are enumerated and described on p.13 of the report):

Advanced transmission technologies: increasing the physical line capacity, either with reconductoring (changing the wires for higher capacity along existing routes) or high-voltage direct current (HVDC) lines.

Situational awareness and system automation: improving visibility on existing grid and automation of processes. These technologies are mostly focussed on improving the system as-is with greater efficiency and reliability rather than evolving it meaningfully (with the exception of distributed energy resources management systems “DERMs”)

Grid enhancing technologies: the suite of technologies that allow the grid to evolve to a dynamic rather than dumb system, including things like dynamic line rating and virtual power plants (VPPs - which have a Liftoff report all of their own).

Foundational systems: boring-but-necessary data and communication systems to enable the whole system to sing.

When you put them all together, this is how they fit:

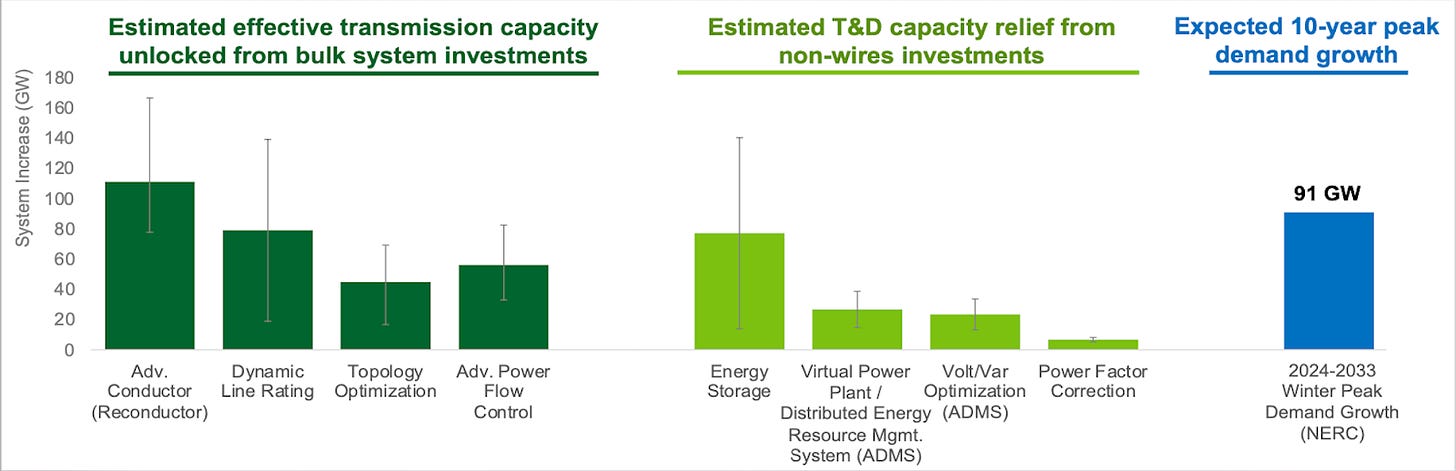

The impact that these technologies can have on grid capacity is absolutely massive in the context of the ramp of increasing peak load. Peak load is what the grids are built for and the main bottleneck that is concerning them now, generally occurring in summer in hot places when air conditioners are running and the winter in some others where electrification of heat is gaining ground. The DoE estimate that these many of these technologies could each unlock between 20-100GW in capacity at full deployment, relative to NERC’s (probably conservative) estimated 10-year load growth of 91GW.

Giving some specific examples (from the report):

Advanced conductors can increase physical transmission capacity between 1.5-3 times conventional steel core conductors.

Point-to-point HVDC systems can increase line capacity anywhere from 40% to over 200% (which can be useful in dense urban areas) and improve line efficiency.

Other solutions such as dynamic line rating (DLR), topology optimization, and advanced power flow control (APFC) can increase system utilization by allowing for transmission lines to increase power flow while still operating within safe capacity margins…they can unlock up to 10-50% additional effective carrying capacity on average.

Technologies and applications like energy storage, Virtual Power Plants (VPP), and Distributed Energy Management Systems (DERMS) can relieve transmission and distribution capacity demands by providing dispatchable energy in the distribution system and behind the meter, avoiding the need for transmission infrastructure all together.

Besides unlocking more capacity, the advanced grid technologies of have other benefits across affordability, reliability (smooth operation in normal conditions), resilience (ability to deal with adverse events) and sustainability:

They also tend to be much more cost effective than building out new infrastructure. The reports cites findings that a $1mm dynamic line rating (DLR) saved the utility anywhere between $13-68mm compared to replacing the wires, whilst a Wood McKenzie report suggests that DERMs is 100x cheaper than equivalent physical upgrades to the distribution infrastructure.

Time to deploy: Compared to 7-10 years for most transmission infrastructure, most advanced grid technologies can see initial deployments rolled out over 1-3 years and then rapidly scaled up afterwards over 3-6 months (see p.22 of the report for more detail of different technologies).

However, the roll out of advanced grid technologies has been slow, and slower in the US than in Europe, with only 7% of the $90bn of US grid infrastructure investment going on advanced technologies last year. Grid investment to date has mostly been in response to short term pressures - weather hardening, new load, retiring generation, new generation, which results in solutions that are geared towards addressing issues in the 3-5 year time horizon. (This lack of planning is precisely what the new FERC rule is trying to tackle.) In particular, grid modernisation investment has been driven by physical threat with a third of investment in the South East where storm damage is costly, and another third in California to safeguard against wildfires.

There is also an issue with aligning incentives. The way that many of the for-profit investor-owned utilities (IOUs) earn a regulated rate-of-return based on cost of service (mostly capex), due to the fact that the grid is a natural monopoly. Simply put, the more money they spend, the more they earn. Currently there are 9 states that have performance based regulation to align incentives better with key outcome metrics with a further 12 states considering adopting such an approach.

Relative penetration of technologies: In the US, there has been relatively more interest on the distribution side, in advanced distribution management systems (ADMS), demand response and VPPs. There has been much less uptake of advanced transmission technologies - reconductoring, advanced power flow control and DLR (Europe is ahead in these with Belgium in particular mentioned as having scaled DLR and advanced conductors).

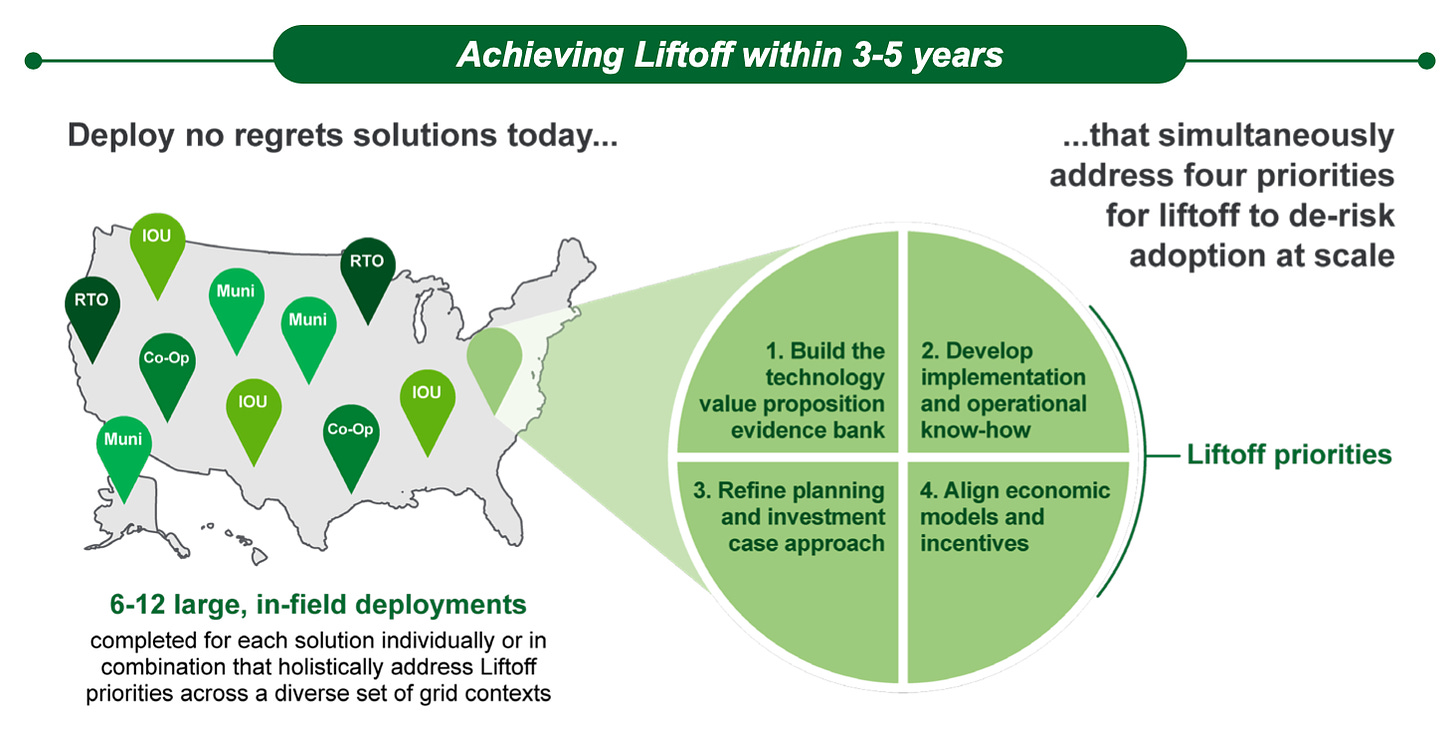

What is required for liftoff? 6-12 scale operational deployment of each technology in different contexts (note that’s similar to 5-10 deployments in different geologies in the geothermal Liftoff report), focussing on developing 4 unlocks:

Building evidence base - the data to show that these solutions work, are cost effective, etc (tech companies and utilities)

Building operational know how - the confidence with the operators that they can manage the projects and operate the technology (tech companies and utilities)

Refine planning and investment approach - developing long term integrated investment plans, as is now required by the new FERC rule (utilities and regulators)

Aligning incentives - ensuring that grid operators are appropriately rewarded such as using performance based incentives (regulators)

Challenges: The four unlocks above address a multitude of challenges identified in the report but they basically boil down to - utilities aren’t yet very knowledgeable about advanced grid technology, they aren’t comfortable assessing and operating them, and they aren’t yet incentivized to change that.

Conclusion: if electricity decarbonisation, electrification of end-use, the manufacturing renaissance and AI-growth are going to happen, there is an immediate and burning need to overcome industry inertia to roll out grid-tech in the next 3-5 years, whilst we simultaneously pursue long distance transmission and low-carbon stationary generation (nuclear and geothermal). And it is a MASSIVE opportunity for start-ups and incumbents alike.

Great piece Bela. Thanks for breaking down a long and at times dull report to something fun and easy to read!