Following the thread from my recent post on the growing clamour for “clean firm” as electricity demand rises, the DoE recently put out the latest of their Pathway to Commercial LiftOff reports - Next Generation Geothermal! It feels like the momentum around geothermal is picking up pace already this year, with Fervo both announcing significant (70%) improvements in drilling times, as well as a $244mm Series B, led by Devon Energy. This is the largest funding round for a geothermal company to date. There have also been announcements of projects, partnerships or funding from all of Quaise Energy, GA Drilling, and Eavor. Given the massive potential of geothermal and the huge leaps that have been made in drilling technology from the oil and gas industry, it’s kind of wild that it hasn’t received much more interest and support up till now. This report, along with their Enhanced Geothermal Shot, represents some welcome focus from the DoE. The industry seems to be on the cusp of an exciting inflection point and could begin to scale with relatively modest amounts of government support or when one of the big oil and gas companies decides to pursue it in earnest.

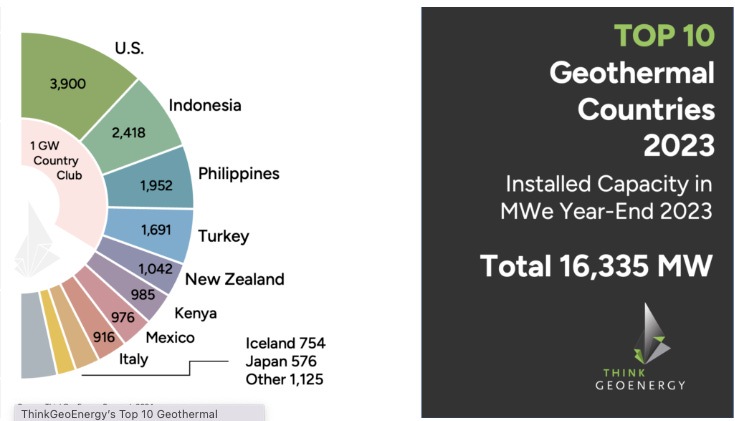

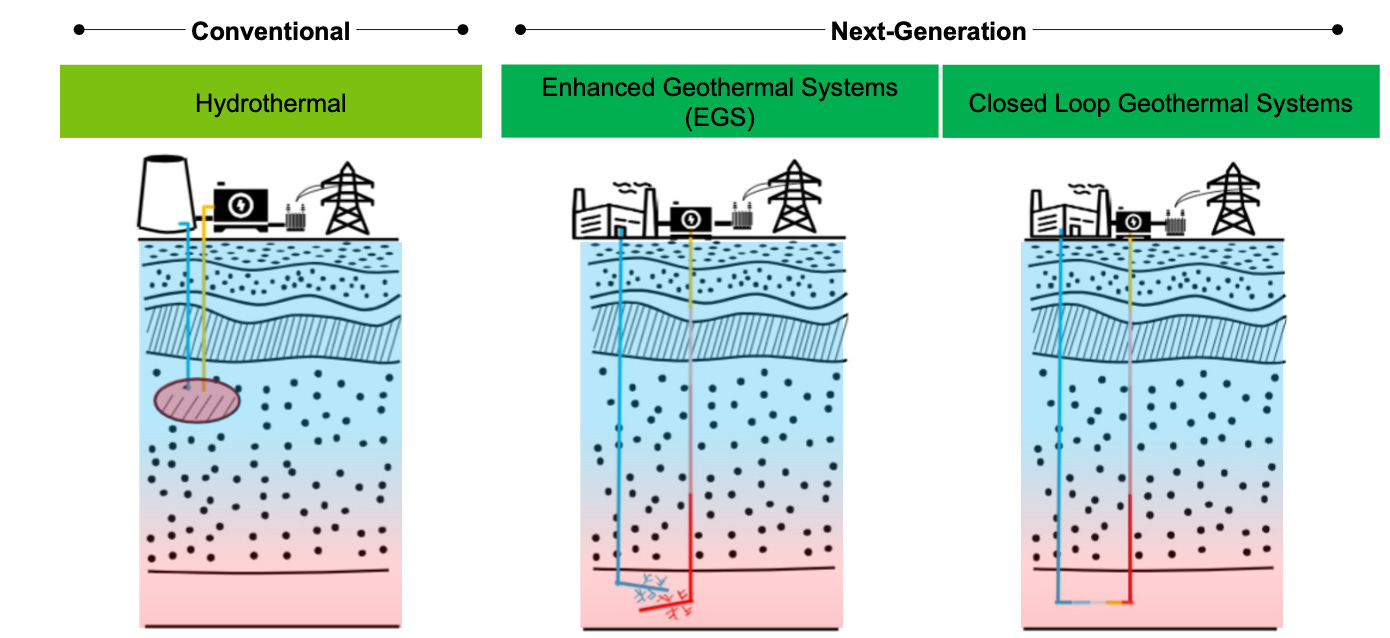

Why does next gen geothermal matter? The big deal about next gen geothermal, Enhanced Geothermal Systems (EGS) and Closed Loop Geothermal Systems (CLGS), is that it opens the possibility of expanding geothermal energy beyond the few very specific places in the world that have the conditions of permeable hot rock required for conventional hydrothermal. Currently global installed capacity (all conventional hydrothermal geothermal) stands at an absolutely pathetic 16GW. Must do better!

Clean firm: Modelling from NREL suggests that the transition to net zero power system will require the US to add an additional 700-900GW of clean firm power. They define “clean firm” as: Power that is always available, even under adverse conditions, and emits low to no CO2eq.

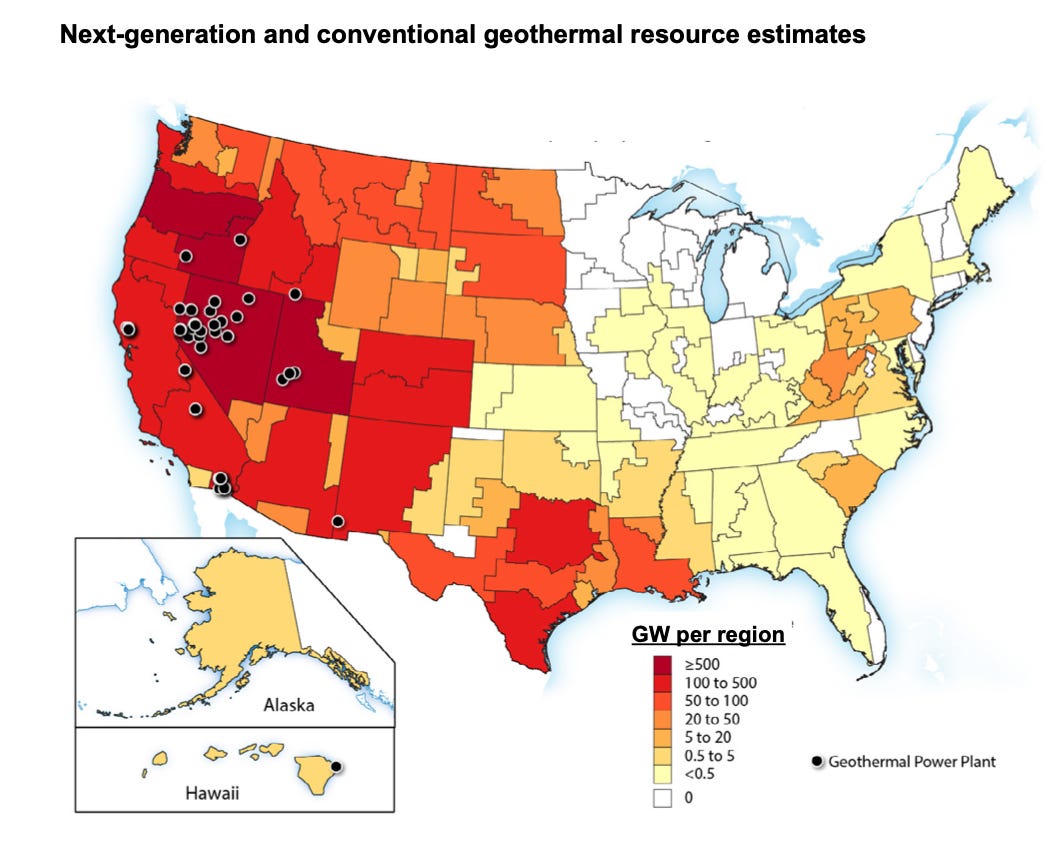

The DoE estimates the total resource for traditional hydrothermal in the US to be 40GW, or which just 9GW has been identified. That compares to over 5500GW for next gen geothermal.

They estimate that next gen geothermal can economically supply 90GW of clean firm power by 2050, or up to 300GW in a scenario that sees land constraints for renewables, plus some more technology development. (Note: the US is already bumping up against constraints for wind in particular, so the land-constrained scenario is very likely. More on that here.)

The two types of next gen geothermal covered in the report are:

Enhanced Geothermal Systems: An open system where an injection well and recovery well are connected by fractures created with hydraulic fracturing. This is technology that has been under development since the 1970s with 65 test projects in 21 countries, but only had the first commercial demo with Fervo recently.

Closed Loop Geothermal System: As the name suggests, the fluid is circulated within a closed system, not working its way through fractured rock, but more like a plumbing system. Because the surface area for heat transfer in CLGS is limited to the sides of the bore hole, it requires much longer wells. Eavor’s 8MW project currently being drilled in Germany is expected to require 220 miles of borehole in total!

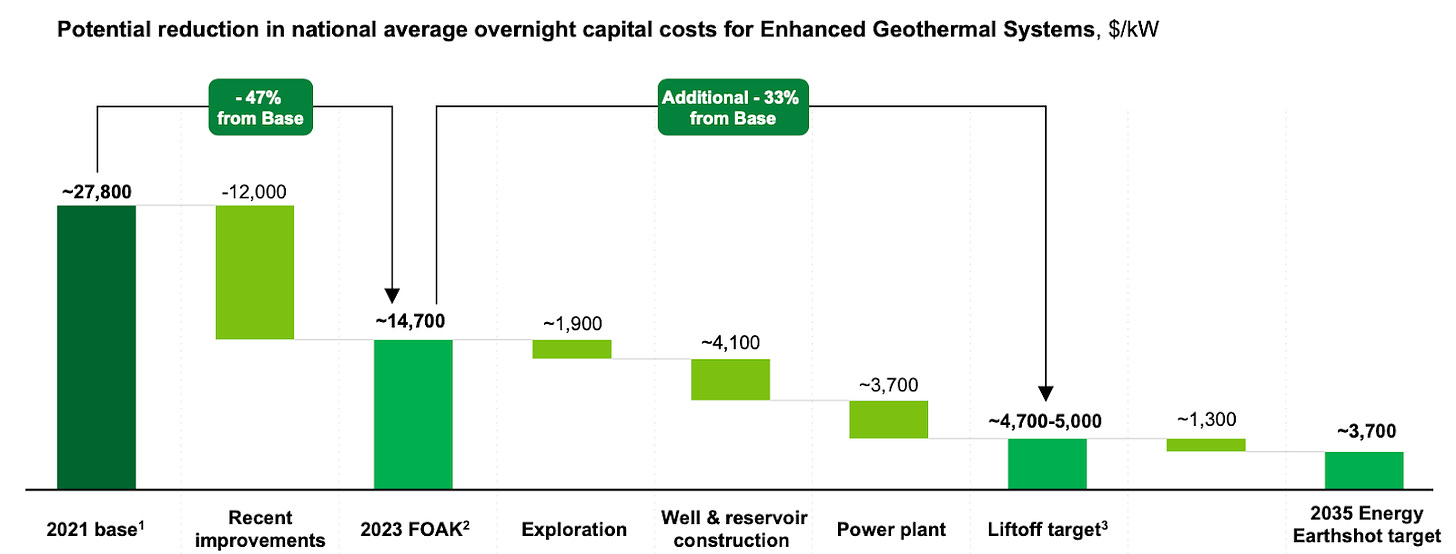

Costs: The Commercial Liftoff target LCOE for EGS is $60-70/ MWh and the stretch target for the Earthshot by 2035 is $45/MWh. That represents about a 60-75% reduction from current level. This sounds like a lot, but progress recently has been dramatic, with costs falling by about half over the last couple of years. The big areas for cost gains are in the well & reservoir construction and in the power plant optimisation. Note that the DoE’s 2035 target for CLGS is around twice that of EGS.

Market traction: Funding for early stage geothermal companies has been ticking up year over year, with 2024 already outstripping 2023 due to Fervo’s big round. On industry engagement, the report notes that the DoE’s Geothermal Technology Office held just two meetings with oil & gas companies on geothermal development during 2016-2020, but hosted over 40 from 2020 to 2023. On the offtake side, subsequent to the report’s publication, Microsoft, Google and Nucor announced a collaboration to pool their power demand to accelerate clean firm technologies, including next gen geothermal.

The report notes four key enablers to scale:

Cost reductions: reduced to $60-70 / MWh

Large-scale demonstrations: projects at 30MW+ showing consistent production over time

High-value PPAs: offtakers willing to buy at prices that reflect the value of clean firm

Community-informed siting: site selection and development in partnership with communities

Investment needs for commercial liftoff: For the new systems to be deemed properly de-risked, it will require demonstration in 5-10 different geological conditions, likely across 100+ developments and 2-5GW of power (the US currently has 3.7GW of conventional geothermal). This for an estimated total investment amount of $20-25bn. The DoE suggests that about $5bn of that will be for FOAKs, coming out at about $450mm for a 30MW FOAK facility.

Raising the $450 million needed for a new development with equity alone dramatically slows the pace at which new projects come online, presenting the single largest barrier to next-generation geothermal scale-up.

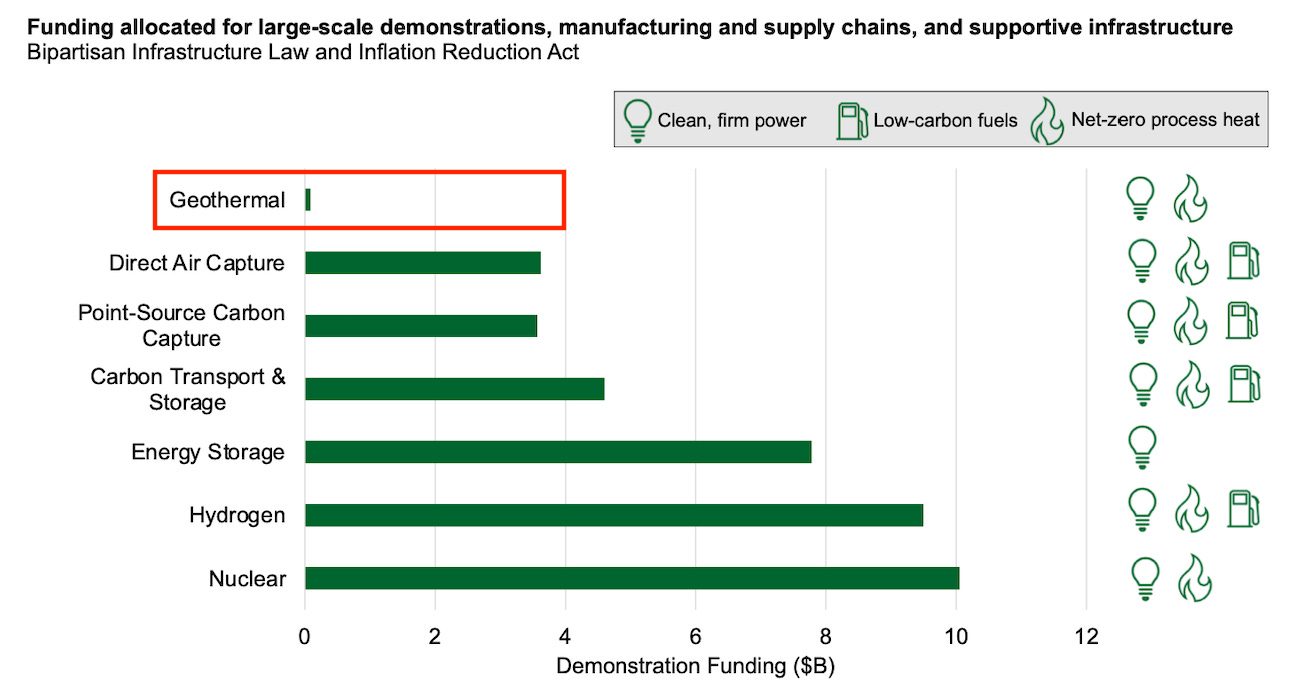

Given the size of the opportunity and the criticality of early financing support, it is hard to fathom why geothermal is so drastically underfunded relative to other technologies:

R&D / Innovation opportunities: The report identified four areas for R&D, which could either be done in-house or we might see develop into standalone opportunities for “picks and shovel” companies, once the foundational tech gets proved out a bit and the market grows:

Resource characterisation improvements - subsurface data that allows developers to more quickly and precisely identify new resources

Reservoir production improvements - improvements in the design of the wells and fluid mechanics to better to capture the heat

Drilling & well construction improvements - drilling faster, cheaper, more effectively

Hardened material - increasingly ruggedised kit to withstand the hostile conditions of heat, pressure and corrosion

Permitting: Geothermal projects have typically taken 7-10 years to get up and running, with especially complex procedures for development on federal land, where most of the projects have taken place. The report also notes that these timelines are unpredictable, which is major barrier to investor comfort. By combining some of the steps so things are done more in parallel than sequentially, this process could be reduced to 4-7 years (more like solar and wind).

Resource distribution: One thing that struck me is that, once again, the North East is not blessed with energy resources. New England has poor irradiance, modest on-shore wind and relatively greater population density. Next gen geothermal for the Western US, nuclear for the East for clean firm?

Superhot Rock: One notable omission of the report is an absence of discussion of superhot rock (SHR) geothermal that taps hotter temperatures of >400 degrees that creates supercritical steam and has much higher conversion efficiency to electricity. That technology is further out but could be more transformative for an energy abundant future. Clean Air Task Force just released a market mapping tool for this sector. In their press release for that they note, “Tapping into just 1% of the world’s superhot rock energy potential could generate 63 terawatts of clean firm power, or enough to meet global electricity demand in 2021 nearly eight times over.”