Welcome to the fifth and final instalment of this series distilling the Energy Transition. So far we’ve really been tackling the top priority - reducing demand for fossil fuels, both by reducing overall energy demands, electrifying and identifying other low-carbon feedstocks and liquid fuels. However, we need to make contact with the reality that fossil fuels are going to be with us for many decades to come and to plan accordingly. Enter carbon management. Generally speaking, carbon management encompasses carbon capture (trapping CO2 from concentrated streams either from combustion or chemical processes) or carbon dioxide removal (“CDR” - taking CO2 out of the ambient air), plus whatever happens once the CO2 is caught, either sequestering it underground (“go back to where you came from!”) or utilising it as a feedstock to reduce aggregate fossil fuel demand. The utilisation piece overlaps with the discussion of green molecules, so we’ll just touch on it lightly here. There is also another massive element of carbon management, which isn’t talked about nearly enough. That is oil and gas scope 1 and 2 emissions. Whilst not traditionally thought of as part of the decarbonisation puzzle, they are too important to omit from this series if we want to be at all comprehensive so we’ve included them here. In case you missed the previous posts in this series:

Part 1: Defining the challenge

Part 2: Energy efficiency and electrification

Part 3: Decarbonising electricity

Carbon Management - not a “moral hazard”

There is something that we should put to bed at the outset here. That is the notion that, by developing carbon capture or carbon removal technologies, we are somehow creating a moral hazard that will result an unduly extended role for fossil fuels. Whilst we should certainly be vigilant for specific instances where this might occur, on a macro level this is a non-issue, propagated by people who either don’t know what they’re talking about or are more concerned with signalling ideological purity than getting real about what the energy transition is going to take. Fossil fuels aren’t going to be with us for decades because oil companies manage to convince us there is a CDR magic wand that will fix the climate. They will be with us for decades because we are not able or willing to build the infrastructure to replace them any faster than that. And that is not because stakeholders have rationalised the climate impact, but rather because it takes a long time to mobilise, permitting is hard, asset owners don’t want to (realistically can’t as fiduciaries - shareholders would change management) mothball long-lived assets and take huge write downs, and, critically, all of these fossil-heavy assets produce the things we depend on as a society (steel, cement, plastic, transport, etc) and the only viable path is “construction before destruction” (to borrow from China’s climate plan). So, no - the threat of moral hazard from CDR is totally immaterial to fossil fuel’s longevity and that “debate” should be permanently sequestered.

Decarbonising hydrocarbon supply:

Oil and gas Scope 1 and 2 emissions: As a quick reminder, scope 1 refers to emissions through on-site activities in own operations, scope 2 refers to emissions related to energy used in own operations and supplied from outside (e.g. electricity from the grid). Scope 3, on the other hand, refers to emissions that occur either in the supply chain or through use of a company’s product or service. The climate community tends to be outraged by suggestions that oil and gas companies might have Net Zero commitments that focus on their scope 1 and 2 emissions but exclude the emissions related to end combustion of their product (which dwarf emissions from own operations).

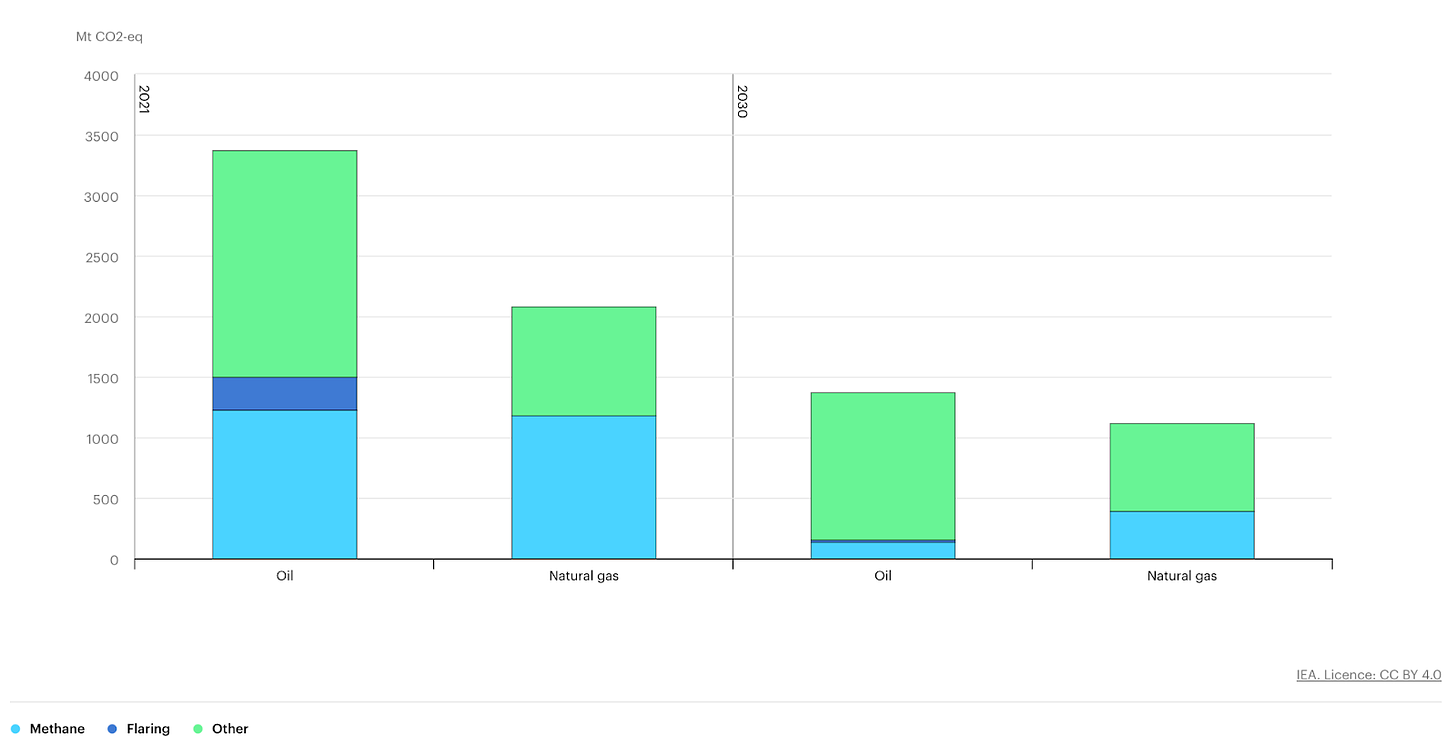

We have an alternative perspective. Two reasons: Firstly, oil and gas companies’ scope 3 emissions turn up in everyone else’s scope 1 and 2 emissions, either used directly or indirectly in their own operations. If all other sectors decarbonise their operations through efficiency, electrification and (for utilities, or commercial industrial customers producing their own power) decarbonisation of electricity, then emissions from the use of oil and gas (i.e. O&G companies’ scope 3 emissions) also falls. Our view is that it is not the responsibility of the oil and gas industry to refuse to supply the hydrocarbons that our society, for the time being, needs. Quite the opposite in fact, as we’re finding out in this global energy crunch. Secondly, scope 1 and 2 emissions from the oil and gas industry, whilst much smaller than scope 3, are very significant indeed, accounting for about 5.5 GT of CO2 equivalent, or a bit more than 10% of total GHG emissions globally. The IEA sees this needing to drop by more than 50% by 2030, largely through reduction in methane leaks. Note that that drop of 2-3GT of emissions would totally dwarf any possible gains by CCS and CDR over the same period.

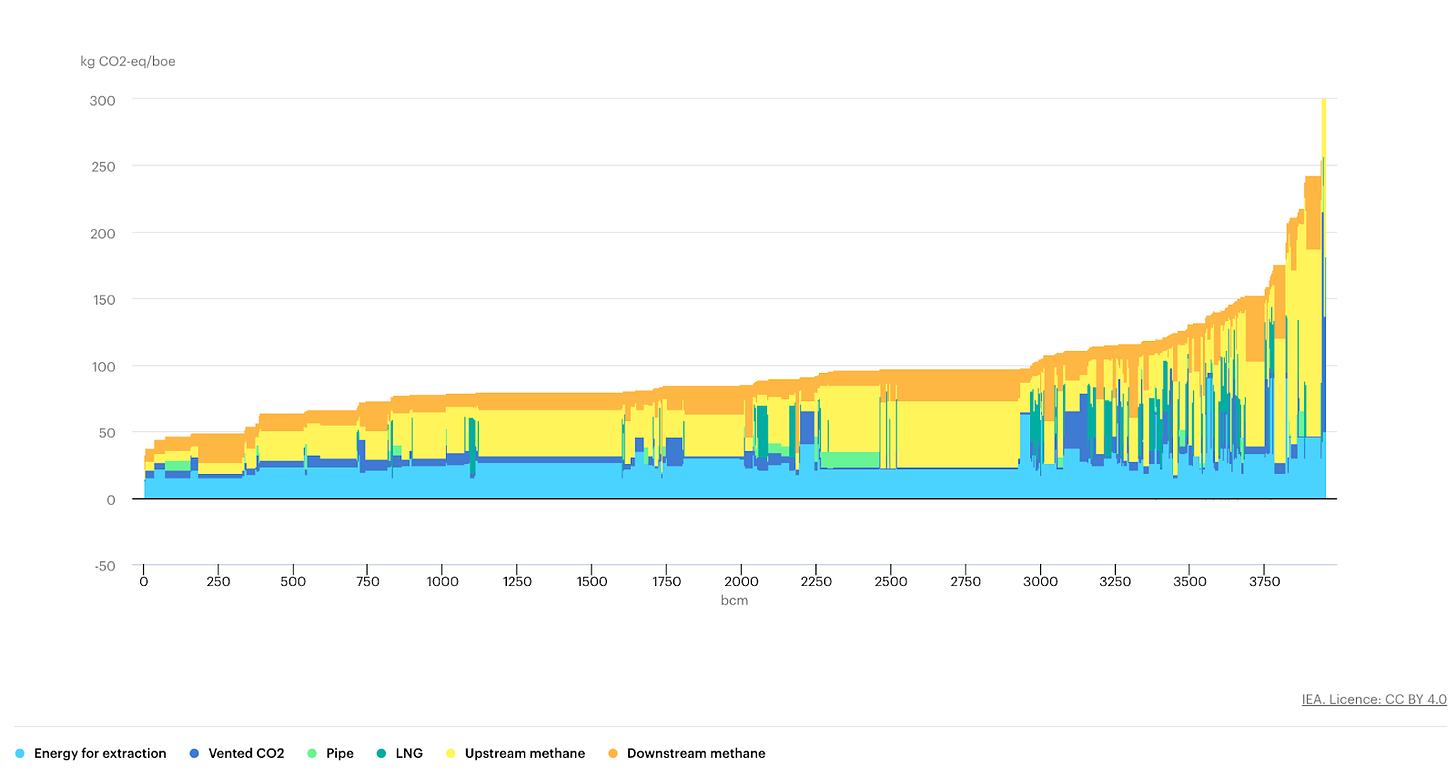

In the case of both oil and gas, the carbon intensity varies drastically between the highest- and lowest-intensity producers (4-5x difference between in both cases). So making climate-conscious choices about procurement is an important first step. Gas chart below, with the scale going from 50 to 300 kg CO2e / barrel of oil equivalent:

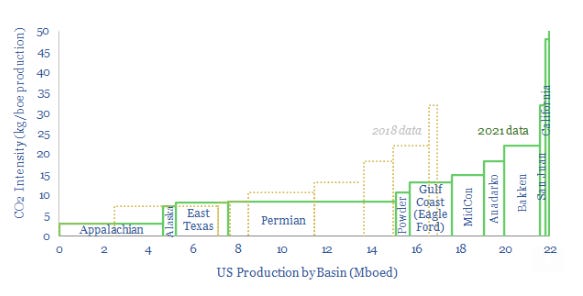

Here is another chart just on US oil production using EPA data (although self-disclosed, so taken with a grain of salt). Californian oil ~15x more carbon intensive than Appalachian:

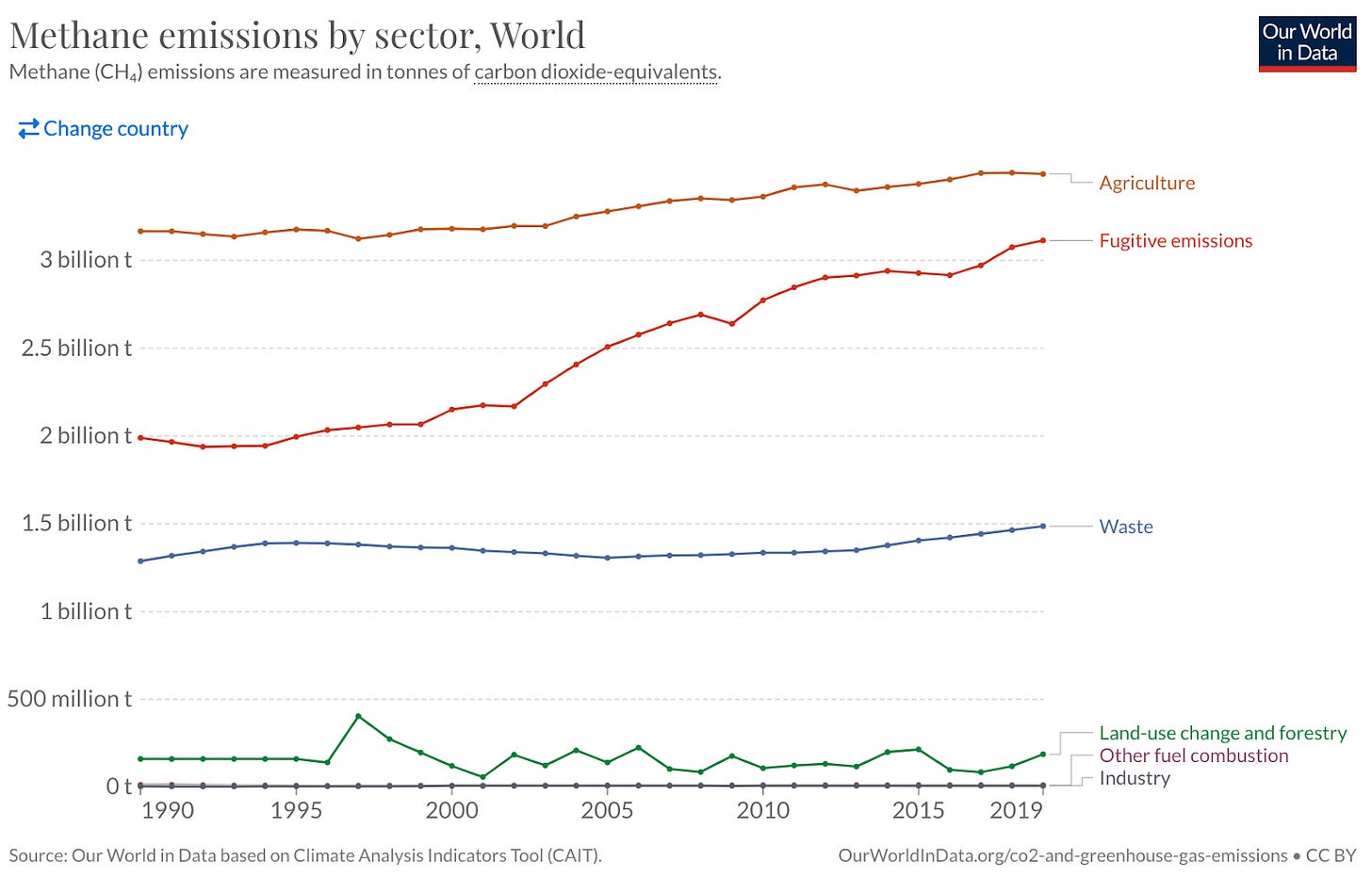

Methane reduction in energy production: As seen in the above two charts, methane leaks represent a huge portion of emissions from hydrocarbon production and it has been growing in recent years, so that now it is almost equivalent to those from agriculture (see below). But there is hope! There have been big leaps in the technology and interest in this area recently, with BNEF estimating the oil and gas methane detection market to reach about $1bn / year by 2025 (e.g. check out Project Canary). The Inflation Reduction Act provides for fines starting at $900 / ton in 2024 and increasing to $1500 per ton from 2026 onwards. It also provided for $1.5bn of assistance for oil and gas companies to upgrade equipment. The key to this will be accountability, so we eagerly await the launch of MethaneSAT, a highly sensitive satellite to detect leaks, which will happen later this year.

Carbon Capture, Utilisation & Storage (CCUS):

Carbon Capture, what is it good for: To reiterate, carbon capture, as opposed to “removal” is capturing CO2 from concentrated sources before it enters the atmosphere. It will be critical for decarbonising industries that are not easily electrified and particularly where there are higher concentrations of CO2, which are relatively easier and cheaper to capture than more dilute streams that require more energy to separate the CO2 from the other gases. That points to things like cement production, chemicals and fertiliser production, ethanol, and oil and gas refining.

How does it work? Up till today carbon capture has been done using chemical absorption, where the flu gas is run through a chemical solvent (an amine) which selectively absorbs the CO2. It is then heated to drive off the CO2 and recover the original solvent. The energy requirement of this necessarily represents a cost and a drag on output (parasitic load) in the power sector. Other approaches that are being developed focus on producing a purer stream of CO2 that can be captured directly. This includes indirect heating for lime / cement production so that the pure CO2 emissions from the chemical process can be captured separately from any heating emissions (LEILAC) or through oxy-combustion where fuel is burned in pure oxygen rather than air, again producing a clean CO2 stream (NET Power, Clean Energy Systems - I also covered this in Decarbonising Electricity), or indeed, by combining the two technologies like Origen Carbon Solutions, where they are using oxy-combustion as the heat source for lime production (which can, in turn be used for carbon removal through calcium looping, but that’s getting ahead of ourselves). There are also alternatives to amine-based solvents in solid sorbents like metal organic frameworks developed by Mosaic Materials (acquired by Baker Hughes last year) and Svante.

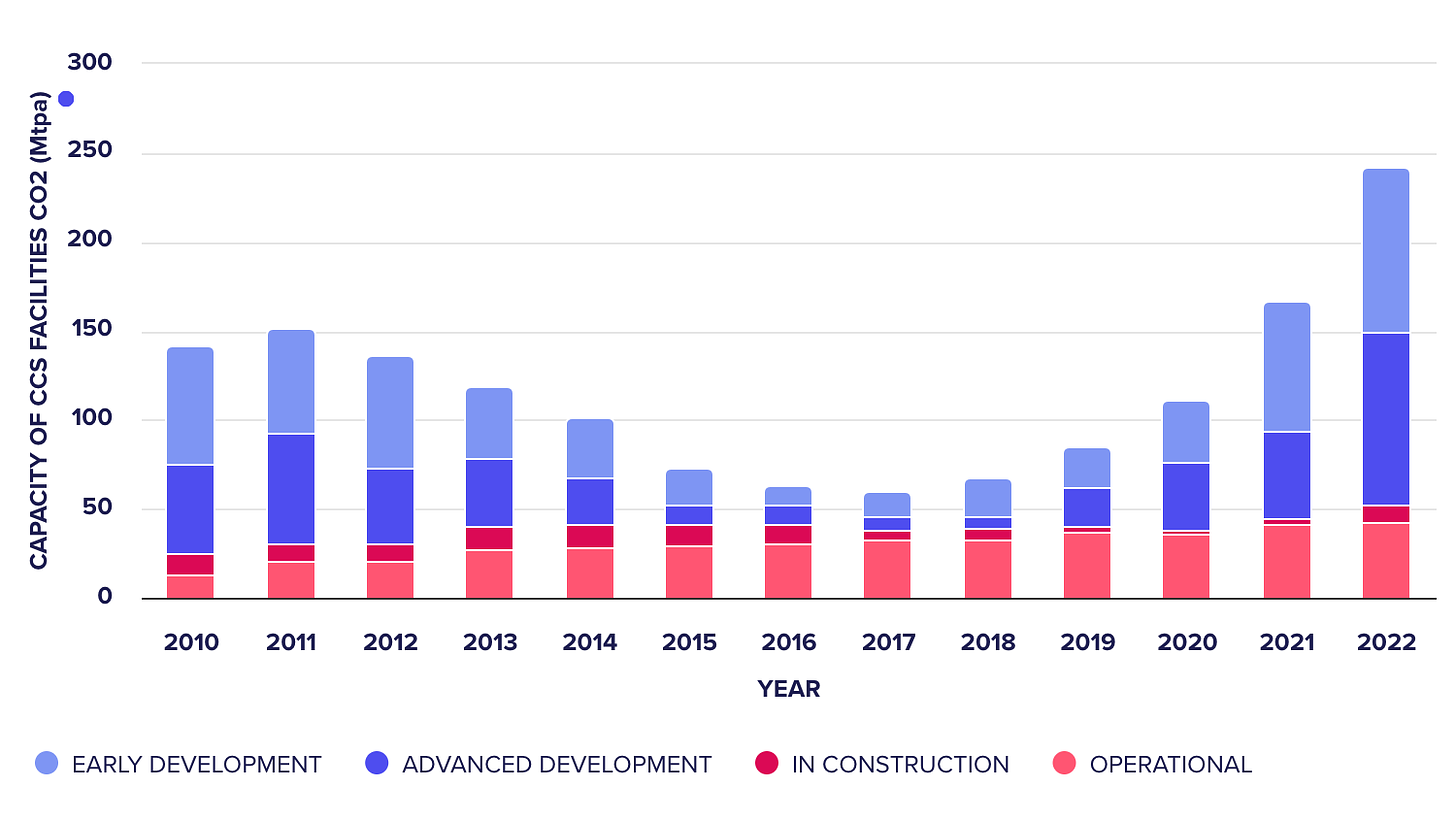

What is the current status of CCS? Today there are 30 operational facilities capturing 42 Mtpa of CO2. Of that, three quarters (30 Mtpa) is used for enhanced oil recovery (“EOR”), with almost all of the rest going to dedicated geological storage. Most of the emissions captured today are from natural gas processing. There are a further 196 projects either in construction or development, with identified capture capacity of about 200 Mtpa (a quarter of the pipeline projects haven’t stated a capacity yet). The number of projects in the pipeline jumped by a staggering 44% between 2021 and 2022. The proportions for EOR vs dedicated geological storage flip dramatically in the pipeline projects - only 14 Mtpa are identified for EOR vs 145 Mtpa for dedicated geological sequestration (the balance is yet to be determined). The biggest sources of capture in the pipeline are natural gas processing (67Mtpa) and power generation (65 Mtpa) with the biggest single project being the East Coast Cluster at Teeside (27 Mtpa) capturing various industrial emissions. The full list of projects can be found here.

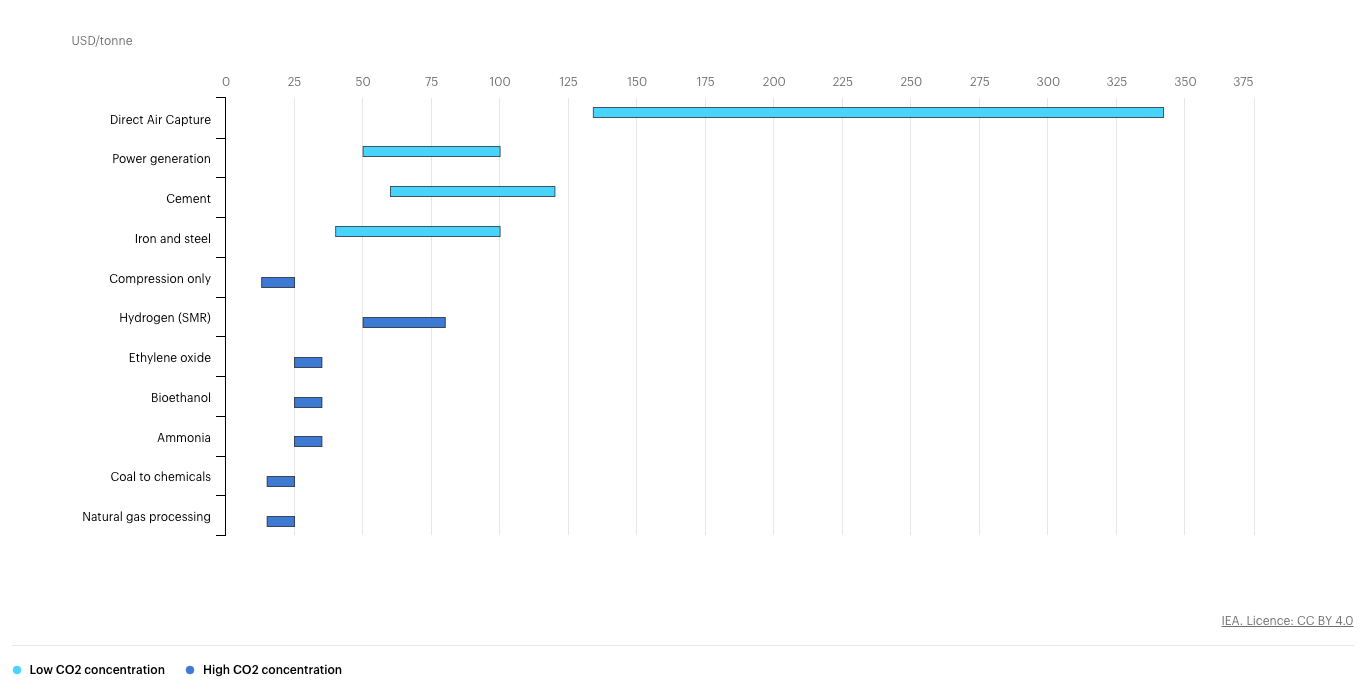

How much does capture cost? The cost of capture varies between sources, with high concentrations being cheaper to capture (as mentioned above). Estimates vary substantially between different sources, but most fall within $25-100 / tonne depending on the source, with natural gas processing potentially as low as $15 / tonne (which seems extremely low). Below are estimated ranges from the IEA (note Direct Air Capture at the top $125-350 / tonne is CDR, discussed more below).

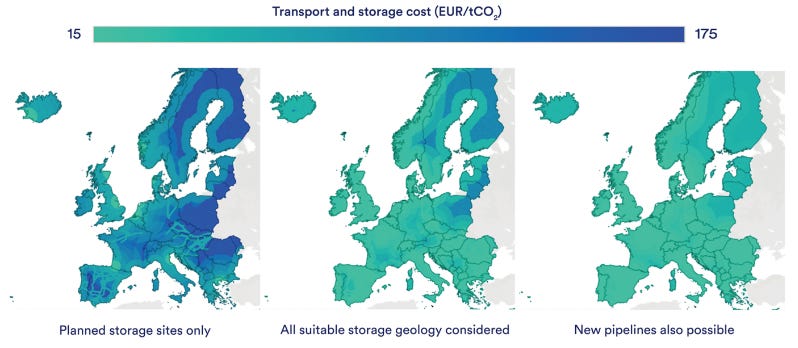

Transport and storage: The total cost of CCS includes not only the capture portion, but also the costs of transport to a suitable storage site and then the sequestration. These costs can be the same again or more as the capture costs and can really be driven down by the buildout of shared infrastructure, particularly CO2 pipelines. This is vividly highlighted by work done by Clean Air Task Force on CCS in Europe. It shows that the costs of transport and sequestration is currently well north of EUR 100 / tonne in many places in Europe, but that the entire continent could fall to below EUR 60 / tonne with the development of more storage sites and pipelines. Work is already underway on a number of shared infrastructure projects including the East Coast Cluster in the UK mentioned above, the Porthos project in Rotterdam and two different pipeline projects for ethanol producers in the US Mid-West, Heartland Greenway and Summit Carbon. Note also that, according to modelling by Zero Labs at Princeton, CCS could be scaled to 200 Mtpa in the US by 2030, but transport and storage infrastructure is the rate limiting factor. There is ample geological storage globally, but a limited amount of expertise to establish and operate the class VI wells for injection and storage of gases. One of the major advantages of carbon removal (as opposed to capture) is that, since the source of CO2 is the atmosphere, projects can generally be co-located with storage facilities, or in some cases, the storage and capture happen in the same step.

Carbon Utilisation:

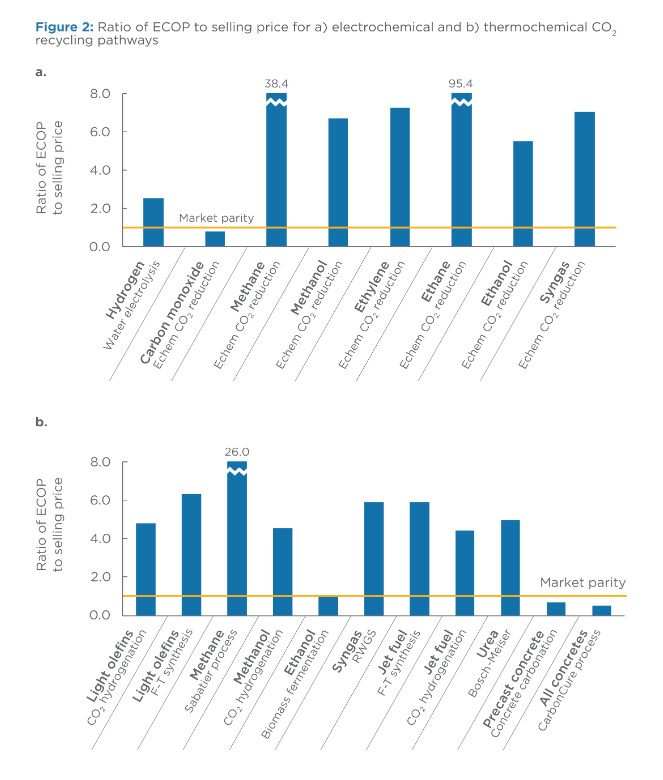

One of the ways to make carbon capture (or removal) more economic is to find someone who will pay you for the CO2. Today the main use for CO2 as an input is the production of urea for fertiliser (where CO2 is mixed with ammonia), but that CO2 is largely sourced on-site as part of the ammonia production. The only scale use of CO2 as a commodity from CCS facilities today is EOR (more below). As covered in Green Molecules, there are opportunities to use CO2 as a feedstock to produce fuel or chemicals, but that tends to be highly energy intensive and expensive. In the most authoritative report on CO2 utilisation, researchers at Columbia identified a few use cases where CO2 utilisation is competitive today and those that are most likely to be in the near future. They conclude that currently profitable pathways represent at 1.6 Gtpa abatement opportunity, with the total CO2 utilisation opportunity at almost 7 Gtpa, but with a current cost penalty of 2.5-7.5x depending on the material.

Enhanced Oil Recovery: EOR generally refers to the process of squeezing extra oil out of partially depleted reservoirs, or tertiary production. One of the ways that can be done is by injecting CO2 down wells to force up remaining oil. On the surface of it, this might seem counter productive as it is producing yet more oil, but almost all of the CO2 that is injected down the well is kept there permanently. Where the CO2 is sourced from facilities that otherwise would have put it directly into the atmosphere, that creates a net emissions saving vs the base case. As it happens, most of the CO2 used for EOR today is sourced from underground reservoirs, so it comes from, and is put back into, the ground. There have been a number of lifecycle analyses done on EOR, the punchline seems to be that it reduces the carbon intensity of oil by about a third, even factoring in something for potentially higher overall oil use (see below). There is even the promise that, if the the CO2 is taken from CDR (i.e. out of the atmosphere) it could result in carbon-neutral oil. Vox have a good primer on CO2 EOR here.

Carbon Dioxide Removal:

There is no getting around it - we are going to need to remove carbon dioxide from the atmosphere, and lots of it. The IPCC has said - stating the obvious - that CDR is unavoidable. Estimates for exactly how much we need inevitably vary but we’re certainly talking about gigatonnes / year by the second half of this century from a standing start. Everyone is pursuing Net Zero because Absolute Zero is a fantasy (although one that is nevertheless sometimes promoted by ill-informed zealots). Even with a monumental effort to decarbonise, there will be certain residual emissions from things like aviation, agriculture and industry that we aren’t able to abate, or to do so would be significantly more expensive than drawing the carbon out of the atmosphere. Once that is done, we have something like a trillion tonnes of legacy carbon that is already destabilising the climate that we’ll want to address over time. So, whatever the exact number is for CDR, we are going to require it on an absolutely massive scale and we need to get there from a standing start.

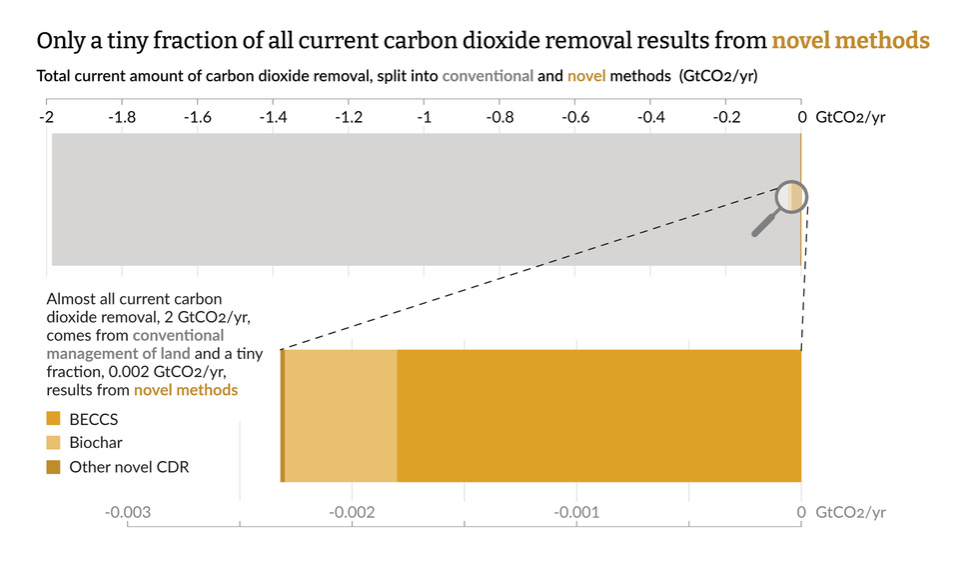

State of CDR today: Earlier this year a number of researchers launched State of CDR. In their inaugural report they find that there is actually quite a bit of CDR that occurs through conventional land management (forest management, reforestation, etc). They estimate that about 2 Gtpa occurs through these pathways, which represents 99.9% of the total. Of the rest, most is BECCS (Bio-Energy with Carbon Capture and Sequestration) at 1.8 Mtp and biochar at 0.5 Mtpa with the balance of novel pathways discussed below coming in at just 20,000 tpa. Note that it is pretty unusual to count CDR from conventional land management, as most discussions focus on novel pathways.

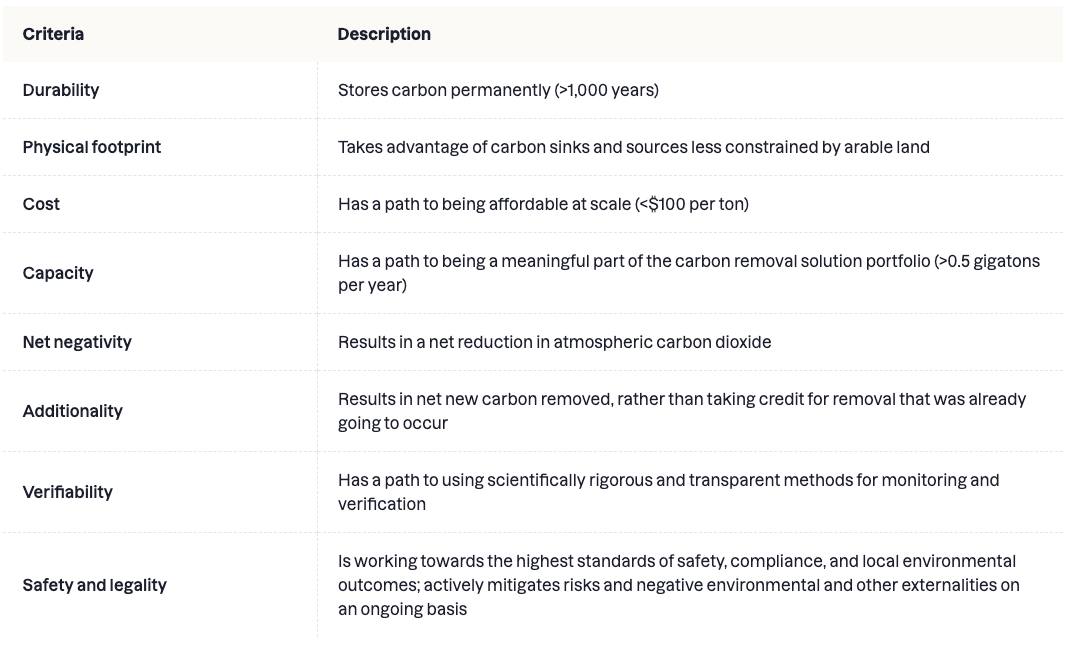

Key attributes for high-quality CDR: There are several criteria that need to be met for CDR solutions to qualify as high-quality. These are set out clearly by Frontier Climate, a collaborative for to serve as large-scale offtakers for emerging CDR projects started by Stripe with a number of other high-profile partners:

CDR Pathways: There are many pathways to achieve CDR. Many of them use or somehow lean on natural fast (between plants the atmosphere) and slow (rocks / atmosphere / oceans) carbon cycles, whereas others, like DAC, are fully engineered. Every single one of these is a deep subject in itself, so this is just the briefest of introductions. You can get an intuitive sense of the relative costs and benefits of each with the Road to 10GT tool. The below list is non-exhaustive, but hits the main categories. A terrific resource in this space is the CDR Primer and there is a lot of content on the Open Air Collective website.

Nature-Based - As mentioned above, effectively all CDR today comes from using natural systems and photosynthesis to lock up carbon. There is huge potential for this to be scaled with co-benefits such as increasing biodiversity. Most of Nature-based Solutions (NbS) refer to forests, but they also could include peatlands (important in our homeland of Ireland), wetland restoration and Blue Carbon (mangroves, seagrasses).

BECCS - An example of cutting nature’s fast carbon cycle, BECCS gets plants to draw down carbon out of the atmosphere, burns them as a fuel, but then traps the CO2, putting it underground rather than back into the atmosphere. BECCS has traditionally been given the most emphasis, but there are serious challenges related to sustainability of feedstock and land-use requirements.

Biochar - Biochar locks in the carbon from wood and agricultural waste streams by heating it an oxygen-deprived environment. This can be added to soil, which has benefits for soil health and water retention. This is a low-cost, technologically-ready pathway with co-benefits, so should get more attention than it does. An adjacent approach is that being taken by Charm Industrial, that are working towards turning agricultural waste into bio-oil and putting it back underground.

Mineralisation / enhanced weathering - This pathway taps into the natural process of silicate rocks absorbing CO2 and turning it into stone. These can be substances like olivine, which Project Vesta is spreading on the coast, or basalt, which can be crushed and spread on farmland, which is the approach being taken by Lithos Carbon and Undo. This approach can also be used with mining tailings and fly ash from coal plants, which gives the dual opportunity for CDR plus environmental remediation, like is being done by Travertine. I wrote more on mineralisation here.

Ocean-based - Focussing on another part of the slow carbon cycle are approaches that seek to increase the ocean’s capacity to take up atmospheric carbon. I did a whole post on this here. A couple of interesting recent developments were the announcement of Ebb Carbon’s series A, led by Evok Innovations and Prelude and the launch of Captura, with the former head of Carbon Engineering at the helm. Both of those are using enhanced ocean alkalinity. Others are looking at sinking biomass into the deep ocean, so the carbon doesn’t get recycled back to the atmosphere (Running Tide, Gigaton in Israel).

Soil carbon - Encouraging higher carbon content in soil through either regenerative agriculture practices (no/low-till, cover-crops, rotation), managed grazing, or with biologics that help to fix soil carbon (e.g. Loam Bio), this is a promising area that we would love to see scaled up, again due to regular co-benefits with biodiversity that come with soil health. This pathway currently is facing difficulties around the measurement part (Enrich Ag and others are working on that) and the difficulty of converting farmers to new practices (other are chipping away at barrier here like Mad Capital).

Direct Air Capture (DAC) - DAC refers to the chemical / mineral capture of CO2 from the atmosphere and is perhaps the gold standard of CDR in that it is clearly additional and measurable, has low land requirements and can be sited anywhere (i.e. next to dedicated storage facilities). The major drawback of DAC (and it is a big one) is that it is incredibly energy intensive. Arguably the two most advanced companies in the CDR space are DAC companies, Climeworks in Europe and Carbon Engineering in the US, who just broke ground on their 0.5Mtpa facility in Texas in partnership with Occidental Petroleum. Occidental is betting big on DAC, with their CEO, Vicky Hollub, suggesting that their carbon removal businesses could soon be as big as their petrochem business. Their development platform, 1PointFive, is way out ahead in terms of their deployment plans over the next decade. A couple of others to watch are Avnos, which produces water as part of their process, and Heirloom, which uses the calcium looping process, similar to Origen.

Carbon offsets:

This is a thorny topic that is too big to get into properly here, but ultimately is an important part of the solution set. Carbon offsets come in many different varieties, but generally involve paying for some carbon-beneficial deviation from a baseline scenario, to provide some additionality. Traditionally there has been a lot of renewable energy projects, as well as more efficient cookstoves that burn less wood, as well as paying to keep forests standing that might otherwise have been cut down (REDD+). Offsets got a very public kicking last year with the release of a report from the Guardian last year saying that 90% of rainforest offsets certified by the main standard aren’t worth the paper they aren’t written on, largely because the baseline risk of deforestation was overstated. This integrity gap is one of the biggest challenges for this sector, where there is abundant demand, if only buyers could have confidence in the projects. The bit of value chain that deals with this is known as monitoring, reporting and verification, or “MRV”. MRV is also critical to carbon removal, but it is less of an issue as it is generally being integrated as those solutions are developed and is often easier in any case. A couple of examples of companies now in the carbon credit rating space are Sylvera and BeZero, but there has been an explosion of activity in the space (arguably disproportional to the current size of the market, so we’d expect to see a lot of attrition).

Major policy supports for carbon capture / removal:

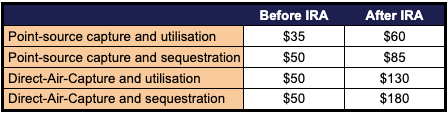

US - Section45Q - The Section 45Q tax credits for carbon management provide a different level of credit for different scenarios and were given a huge upgrade under the Inflation Reduction Act. The IRA also changed the threshold for projects to make much smaller projects eligible and pushed out the required start of construction date to the start of 2033.

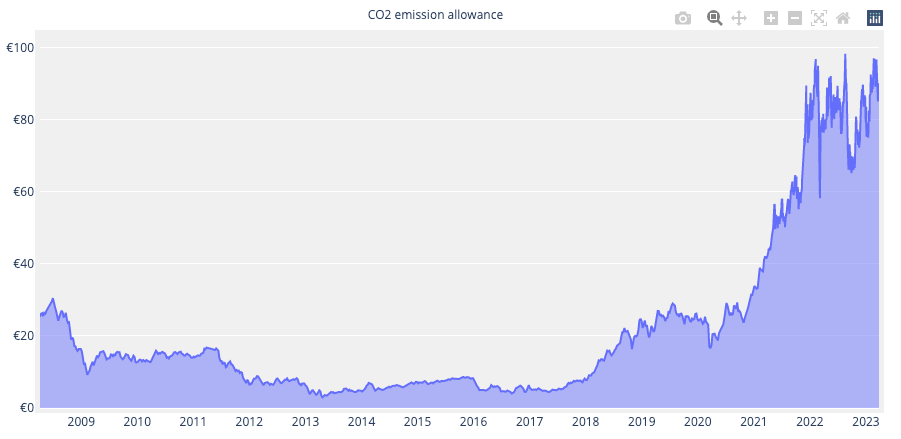

EU - Emissions Trading System (ETS) - The ETS is Europe’s cap and trade system, whereby the allowable amount of credits (EU Allowances or “EUAs”) reduces over time and those polluters who exceed their threshold need to buy credits from those who managed to reduce emissions below their allowance. The scheme currently covers the energy sector (power and heat production) plus most heavy industry and intra-European aviation. The cost of EUAs has surged over the last couple of years as reforms have been implemented, putting a lot more CCS projects in- or near-in-the-money.

And with that, we conclude our speed skate over the surface of the Energy Transition. As you can see, there is a lot to do, which also means there is no shortage of opportunities. This transition is going to be multi-decadal. We have no time to waste, so we need to feel the urgency, but also need to settle in for a long journey. My hope is that this series can serve as a jumping off point for readers and has helped to add some clarity and framework to an often bamboozling space. If readers have any questions or comments, I’d love to hear from you. We’re always trying to get to better answers and to better outcomes. Onwards!

Great job Bela! Always very comprehensive and practical, love it. Too bad this is the last of the series!