Decarbonising electricity follows after efficiency and electrification in this series but is actually the killer app for Net Zero. Energy efficiency may be the “first fuel” of the energy transition, but we can’t efficiency our way to zero. On the other hand, there is very little we couldn’t do with sufficiently abundant and cheap (near) zero carbon electricity, including, in extremis, removing carbon from the atmosphere via direct air capture and either sequestering it underground or combining it with low-carbon hydrogen to making net zero liquid fuels. We are still quite some ways from that sort of abundance, but, as per the sector chart in the last post, the electricity sector is the one area where some real progress is being made on decarbonisation. In this post, I’ll take a look at how we are doing so far and how we might think about the different ingredients for a zero emission power sector that meets not only today’s electricity demand, but the vastly expanded electricity sector of the future that has subsumed transport, residential heating, industrial heating, etc, plus met the growing energy demands of developing countries. I’ve been helped here by the timely recently publication of the IEA’s Electricity Market Report just last week.

Where are we at?

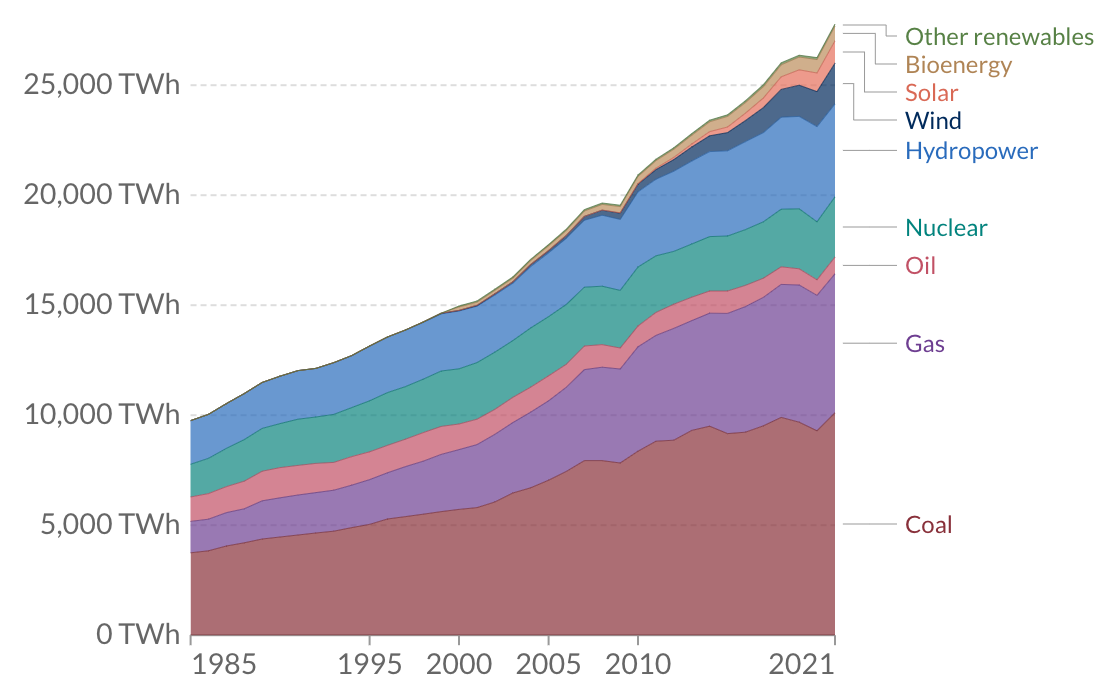

Currently the world uses about 28,000 TWh of electricity annually.

Coal is still king in the electricity sector, accounting for about 35% of global electricity generation, ahead of gas as the next biggest source at a bit over 20%.

Hydro is still the largest source of low-carbon electricity, followed by nuclear. However, both have experienced pretty meagre growth rates in recent years, compared to the exponential growth of wind and, particularly, solar.

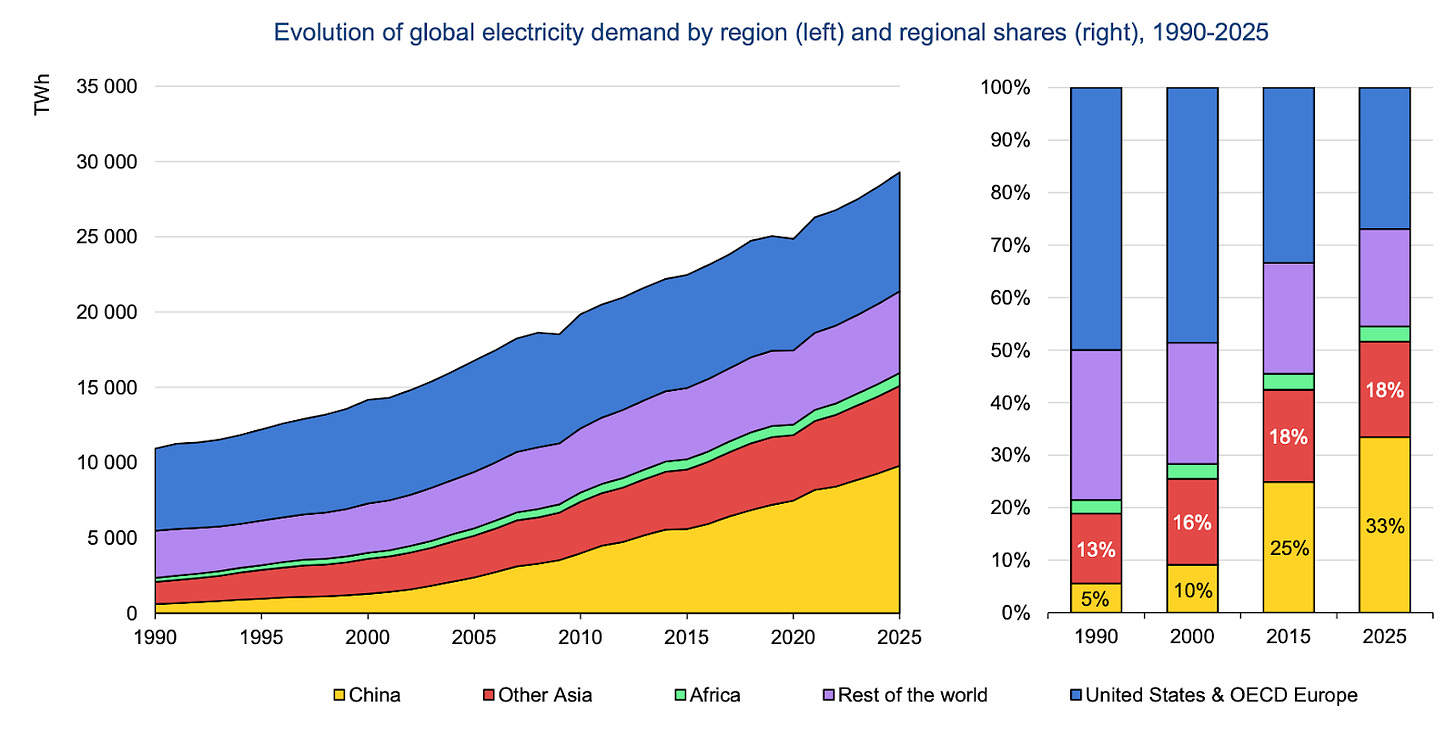

Demand growth - although developed market electricity systems will need to expand to account for greater electrification of end-uses, the immediate demand growth will (continue to be) driven by Asia and China in particular, which is expected to represent a third of all electricity demand by 2025.

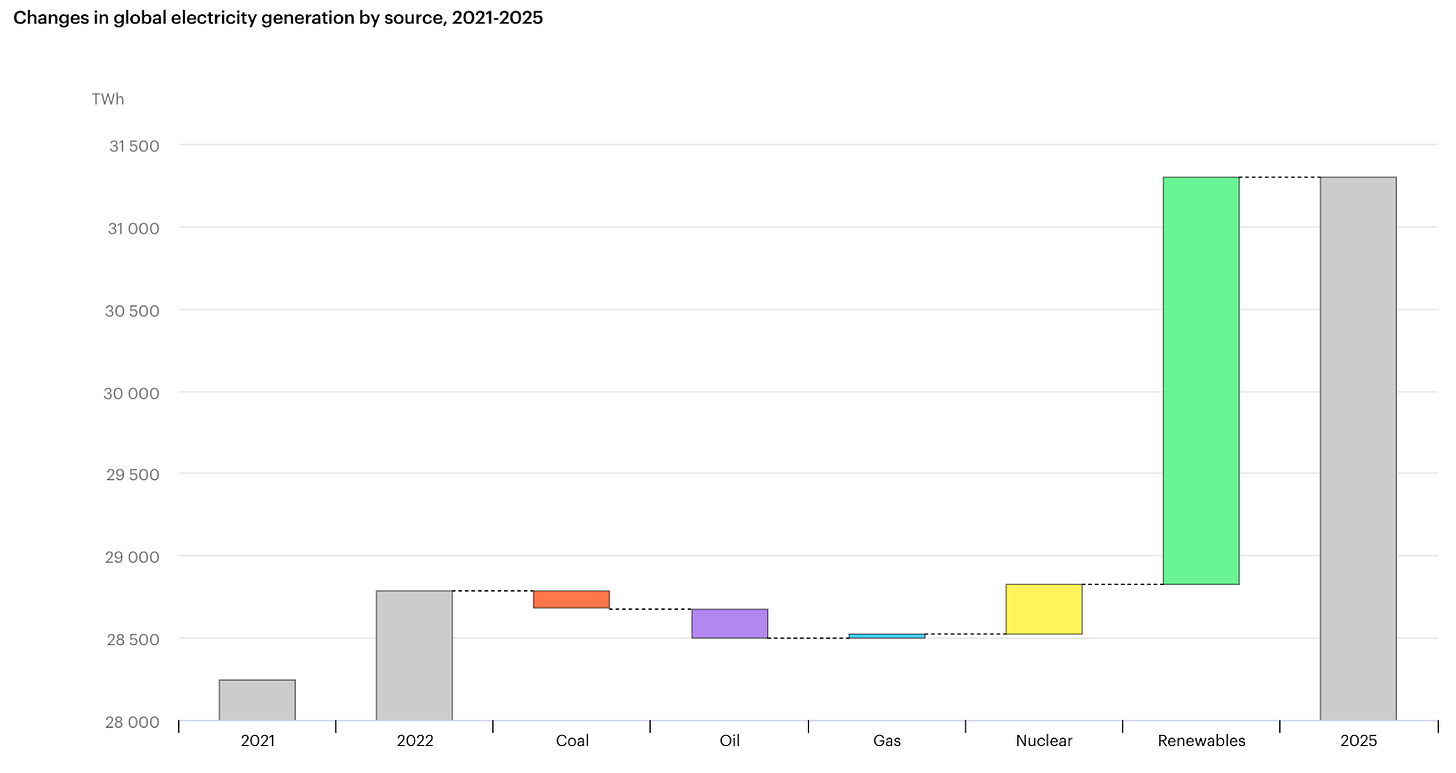

The good news is that, now that wind and solar are the cheapest forms in electricity in most places, we are collectively doing a pretty good job of meeting incremental electricity demand with low-carbon sources (new coal in Asia being offset by closures in US and EU). The IEA estimates that about 90% of demand growth over the next few years will be met by wind and solar with most the rest coming from nuclear.

The bad news is that low-carbon sources, whilst edging out fossil fuels on the relative basis, still aren’t yet putting much of a dent in the absolute level of fossil generation and, hence, emissions in the global power sector. The IEA expects emissions from electricity generation to be broadly flat through to 2025. BUT, where incremental demand is being driven by electrifying end uses, and that incremental demand is being met by low-carbon electricity, then it still reduces emissions of the energy system as a whole.

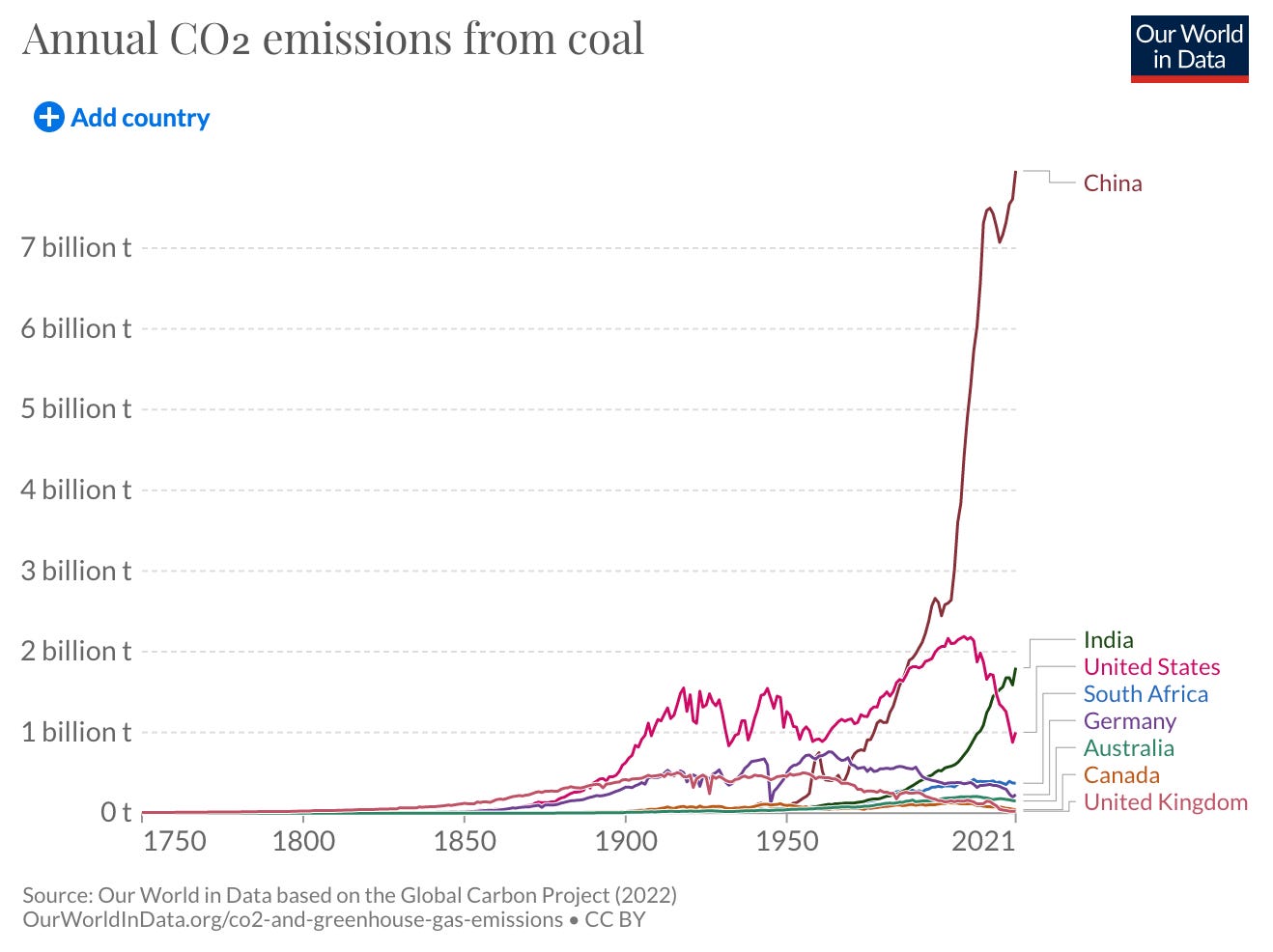

The clear priority for reducing absolute emissions from electricity is to phase out coal. Coal is responsible for about 10GT of the 13GT of annual emissions from the power sector, which is, once again, mostly China, followed by India and other Asian countries. If we look at emissions from coal use in total (not only the power sector), China’s role in pretty striking:

Before we get into the pathways for driving electricity towards zero carbon, it’s worth touching on a few concepts.

Levelised Cost of Electricity (LCOE) - this is the measure that is meant to capture the overall cost per unit of electricity delivered. A good report to dig around on to get a sense of competing technologies is Lazard’s LCOE Report. One important qualifier is that LCOE metric only captures the isolated costs of the generation. It does not capture the system costs of integrating that generation into the system. When these are included, the actual costs for variable renewables are shown to be much higher than the LCOE would suggest and increasing with increased grid penetration. The calculation for LCOE can be split different ways, but is essentially made up of three components:

Capital costs - There are two inputs into this. Firstly, the capital outlay - how much does it cost to build the generation capacity per MW of potential output, whether that be a gas CCS plant, wind farm, etc. Secondly, the cost of capital - what is the interest rate you are paying on the financing to fund the capital expense. The perceived different risk profiles between fossil and renewables here gives renewables a distinct advantage as investors demand a lower return on wind and solar.

Operating costs - for fossil power plants this is mostly the cost of the fuel - gas or coal. Nuclear operating costs include fuel, but it is a smaller portion as they also include waste disposal and decommissioning. Operating costs for wind and solar are a smaller portion of the LCOE as they get their ‘fuel’ for free.

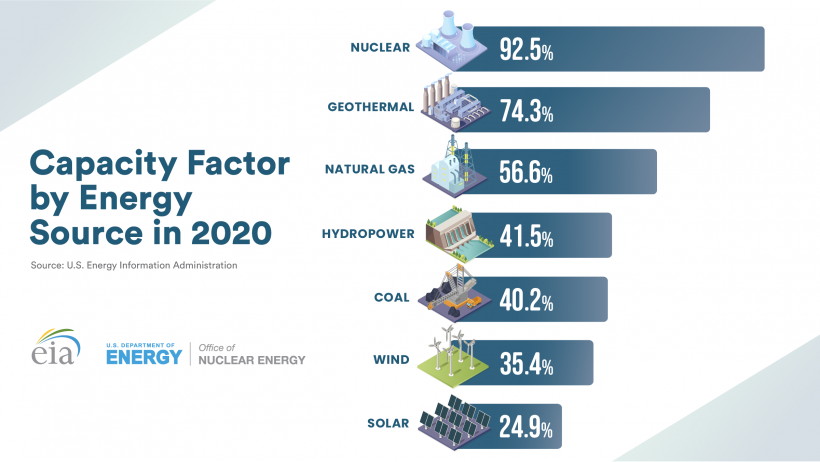

Capacity factor - this refers to the amount of time the generating source is running and therefore the amount of energy the capital costs can be amortised over. This is an important concept that is often glossed over as the press so often reports changes in installed capacity. Installed capacity doesn’t reflect the overall contribution to the grid, as, for example, solar farms don’t produce any power at night. The capacity factor of different technologies varies radically between different countries or regions, but the below from the US gives a sense - you need 3-4x installed capacity of renewables to produce the same amount of electricity as nuclear:

Life-cycle emissions: No electricity source is truly zero carbon as they all involve emissions at some point during their lifecycle. Solar panels require energy intensive manufacturing, wind turbines require copper and steel, hydro dams require steel and cement. According to NREL, the absolute lowest lifecycle emissions are jointly wind and nuclear, but everything not fossil fuel based is such a vast improvement on fossil that differences between them fade to insignificance.

Material Requirements: Supply chains in general and for critical minerals in particular have really swung into focus in the last year. The energy transition is going to require a lot of stuff. The IEA recently flagged copper and nickel in particular as having large investment gaps. You can see from below that nuclear has much lower requirements of critical minerals per unit of energy than wind or solar, and that isn’t even accounting for associated requirements for batteries.

So how do we get there?

There are many different ways to skin this particular cat. The path taken will depend not on technology only, but also on political, public and industrial support. The most work has been done on modelling the decarbonisation of the US grid. There have been multiple detailed studies, each of which have multiple viable pathways to get to the end goal. The Breakthrough Institute does a good job of comparing the central scenarios of three credible studies - Net Zero America, Vibrant Clean Energy, and this one by a team from Evolved Energy Research and others. There is also another detailed study by NREL released last year.

Almost all scenarios have on-shore wind as the biggest contributor to an expanded and clean electricity grid, with solar making up most of the rest and then nuclear playing a stable or expanded role, depending on the capacity to deploy renewables. In any case, we are looking at something like 70-80% combined for wind and solar, up from about 12% today. From here on out, there are two main areas we need to focus on. Firstly - expand wind and solar as much as possible. Secondly - build out low-carbon firm generation.

Expand wind and solar

Wind and solar deployment is really hitting an inflection point where they will start to make up a meaningful portion of generation in the coming years. But their variable nature means that we need to make a lot of system adaptations to maximise their integration. We’ll take a look at these below. In addition to these integration measures, there are now lots of companies working on reducing the costs on the generation side by tackling those different levers - capex, opex, and capacity factor - to make renewables cheaper.

Transmission - renewable resources are very often not located close to demand centres and the land use requirements can be challenging in densely populated regions. This requires the transport of electricity over long distances. Transmission across regions also allows much greater flexibility in the grid to draw supply from different generation sources. There are various ways to squeeze more out of the existing grid including upgrading the wires the higher-capacity conductors (e.g. those being developed by TS Conductor) and better optimisation of existing hardware (e.g. LineVision, SmartWires). There are also a couple of companies working on high-temperature superconductors for long-distance transmissions - BEV-backed VEIR in the States and SuperNode, based here in Ireland. But, whatever the tech, there needs to be a vast expansion of long-distance transmissions capacity. In NREL’s high-wind and -solar scenarios, they have transmission increasing by 2-3x compared to less than 10% increase in the reference scenario. Tackling the permitting challenge is critical if we are to achieve this. I wrote more about the topic of transmission here.

Grid balancing:

Utility-scale storage: Already around half of new wind and solar projects applying for grid connections are paired with batteries generally with 4-8hr of storage to balance supply and demand over the day. New utility scale storage will be dominated by lithium-ion batteries in the near future given the momentum and build out of the industrial base, although (underreported) pumped hydro still accounts for 90% of storage today. BNEF estimates a 15x increase in energy storage up to 2030, with most of that (60%) for utility-scale shifting of energy supply.

Distributed Energy Resources (DERs) - can be used to either reduce demand or increase supply (more on those here):

Demand side response (reduce demand): reducing demand at times of lower electricity supply has been around a long time, traditionally involving the utility picking up the phone to a commercial or industrial customer. Increasingly this will be digitised as more smart devices are managed with software to allow them to shift the demand according to the grids needs - e.g. heatpumps / AC or EV charging (see fresh announcement from Sonnen).

Virtual Power Plants (increase supply): VPPs cover the broad category of aggregating many distributed generation sources to provide electricity back to the grid. This generally will draw on rooftop solar, home batteries and eventually vehicle-to-grid (V2G) enabled EVs. Recently it was announced that Lunar Energy teamed up with SunRun to operate its VPPs across 10s of thousands customers with home batteries. Other companies in the DER area - Leap Energy, Camus Energy, Octopus Energy, Therma (using cold chain assets) and Arcadia.

Long-duration storage:

Multi-day: Renewables penetration isn’t yet high enough for this to be a burning need, but we need to start work on it now so eventually we can cover multi-day lulls in wind, for example. Even a lot of the energy storage companies branding themselves as “long-duration” are really only reaching 10-12 hours of storage. The company that seems to have the most momentum for multi-day storage is Form Energy, which has contracts to deploy two 100hr batteries with an output capacity of 10MW and capacity of 1000 MWh. One to watch closely, but that is at an earlier stage of development is Noon Energy, whose series A was led by our friends at Clean Energy Ventures recently. A few other companies that get out past the 4-8hrs of li-ion but aren’t quite multi-day - Energy Dome, Hydrostor, Quidnet Energy, eZinc.

Seasonal storage: Energy demands, particularly in densely populated northern latitudes, have large seasonal disparities for energy needs, as anyone closely watching Europe’s weather and gas storage levels this winter will be acutely aware. Ultimately we will want to be able to shift abundant summer solar to cover gaps in winter energy demands. Again, we won’t hit this level of dependence for some time, but it will be a challenge. This very long-term storage will likely take the same form that we currently store most of our energy in - molecules (we normally refer to them as oil / gas / coal). This could be hydrogen, or if we are happy to trade energy efficiency for ease of storage and transport, we could turn hydrogen back into synthetic fuels. This will be expensive energy, but will only form part of our energy use, if we go this way at all. However, it’s possible (probable even) that we’ll stick with natural gas to cover seasonal shortfalls. (I was surprised to see a pretty significant chunk of H2 seasonal storage in 3 of NREL’s four scenarios.)

Clean baseload / firm generation

Whilst the backbone of future clean electricity grids might be wind and solar, the majority of low-carbon electricity historically, and still today, come from hydro and nuclear. The only developed economies today with very low carbon intensity of electricity are heavily dominated by hydro and / or nuclear - Sweden, Norway, France, Canada, Switzerland. So there is a demonstrable path to having a very low carbon grid with little or no variable renewables, whist the reverse has not been demonstrated. Additionally, a number of baseload technologies create heat, which represents 50% of final energy demand, so can be used to provide that directly rather than going through the medium of electricity. Let’s take a look at the different options - now and in the future.

Hydropower - currently delivers 15% of global electricity and is about equivalent to all other low carbon generation put together. However the outlook doesn’t suggest that hydro will be a major source of new generation over the next decade and beyond as it is very site-specific and most of the best resources have already been developed. There are some people working on electrifying existing dams (Rye Development) and trying to extract power out of man-made water infrastructure (Emrgy), but it will be a relatively marginal contributor.

Nuclear - ah, nuclear. Joint lowest lifecycle emissions, lowest land use, safest form of generation per unit of energy delivered, and, in many large economies (e.g. US) still the biggest source of low-carbon electricity. Nuclear energy is swinging back into favour as the global energy crisis underscores the necessity for energy security and resilience as well as decarbonisation. However, a long period out of vogue and a culture of excessive caution has allowed supply chains and skills to atrophy and left the nuclear industries with precious few successes to celebrate.

Currently, most of the planned construction is in China (as usual) and India, but with the UK committed to expanding its fleet, along with France, Romania, Poland, Netherlands, Sweden, Estonia, etc, it looks like we’re on the cusp of a broad renaissance. There has also been a flourishing of new innovation in the space. SMRs that look like smaller versions of traditional reactors such as NuScale and GE-Hitachi’s BWRX are the furthest ahead. GE-Hitachi’s design looks like it will be the first to be built in the West, in Canada (why, yes, China does already have one well under way), with NuScale having advanced talks with multiple countries and recently fully completing US licensing of its design. There are other designs of similar scale but newer designs, mostly using a high-enriched fuel (known as HALEU) and different coolants, such as molten salts or gas. These include, amongst others, X-Energy and Bill Gates’ TerraPower (both in the US’s Advanced Reactor Demonstration program), Terrestrial Power, and Moltex (headed by a fellow Irishman and Trinity College alum!). These new designs also tend to have the capacity to be ramped up and down to compliment a renewables-heavy grid. Then there are others pursuing micro-reactors in the 1-20MW range, including Radiant, Ultra Safe Nuclear Corp and Oklo, that could replace diesel generators in remote areas like mining operations or military bases, or serve large single users like university campuses. Another company in this last category with a design that utilises all existing technology is Last Energy, looking to build 20MW reactors to supply behind-the-meter electricity to industrial customers. One of the most exciting potential applications for advanced nuclear is to repower coal plants, allowing them to reuse the site, the grid connection and, depending on the age of the coal plant, some of the balance of plant. More about coal-to-nuclear here.

Natural Gas with CCS: what if we could get the benefits of fossil fuels without the negative externalities of emissions? Previous attempts to do post-combustion capture on power plants have ended in failure due to the expense of capturing the CO2 in a relatively dilute flu gas, needing to separate out the nitrogen and other pollutants. NET Power have developed an oxy-combustion technology where natural gas is burned in pure oxygen, creating a pure stream of CO2 which is then easy to capture and sequester. They also use the hot CO2 as the working fluid to drive the turbine, which has advantages over steam, but also complications (as Rob West of TSE explains here). More on NET Power here. Another company using an oxy-combustion technology is Clean Energy Systems, although they envisage using a classic steam turbine. We have a massive task to decarbonise energy and need all the levers available to us, including fossil fuels where we can make them compatible with our climate ambitions.

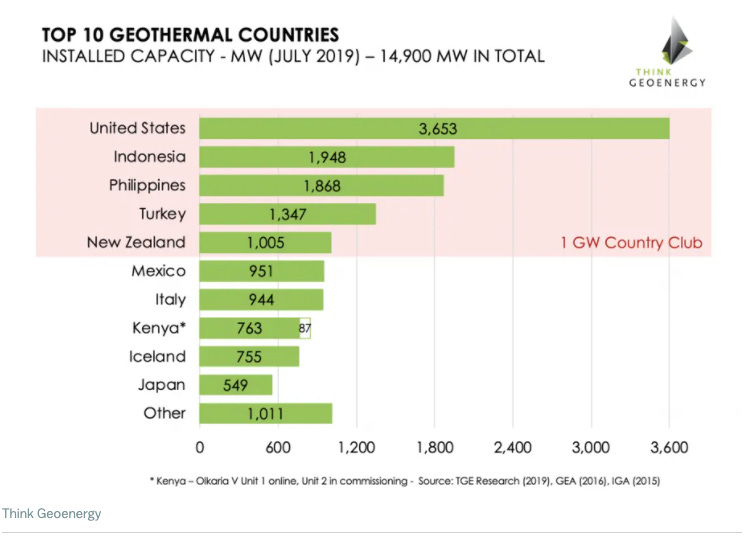

Geothermal: Today, geothermal represents a tiny portion of the global energy mix as it is extremely location dependent, requiring heat near the surface, permeability and water. There is only 14GW of installed capacity, with only 5 countries having more than 1 GW.

But advances in drilling technology in the oil and gas industry are opening up the prospect of economically accessing new heat resources. A few companies using techniques from the O&G industry are Fervo, Sage, and Eavor. However, the most compelling, if technologically difficult, approach is to try to drill much deeper to access higher temperature heat. This has the dual benefit of being able to access geothermal energy anywhere, and allowing much more efficient conversion of the heat to electricity (more on that here). The challenge is that, at those depths and temperatures, mechanical drilling equipment melts. Slovakian company GA Drilling and Quaise Energy (spin out from MIT) are respectively developing plasma and millimetre wave drilling techniques. If they are successful, they could unlock functionally limitless energy, and also be in a position to provide heat to repower coal plants. Whilst still early days, it’s exciting stuff!

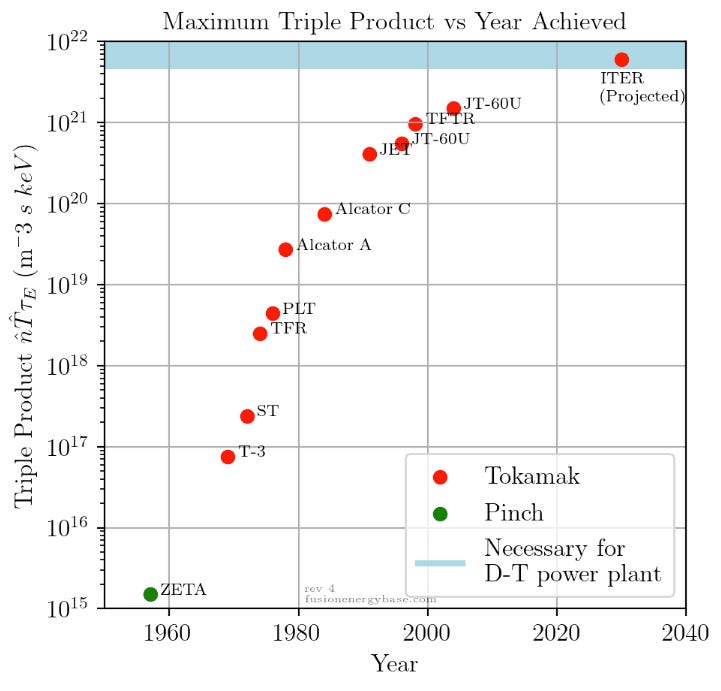

Fusion: Just because something is hard or far away, doesn’t mean it isn’t worth doing. Fusion definitely falls into this category. It won’t have a short term role in grid decarbonisation, but successful realisation would have huge implications for clean energy abundance and humanity’s long-term ambitions. Fusion technology has been making steady progress over the last several decades, but the inflection point where it starts to become interesting has only recently swung into view. Below shows the progress on the “triple product” conditions of heat, density and time of confinement that allow for fusion conditions in plasma. Note that it is on a log scale so these are exponential gains and also they don’t include recently improvement including the recent milestone (not breakthrough) of ignition at Lawrence Livermore.

There has been a proliferation of startups taking on the challenge of commercialising fusion energy, supported by the advances of enabling technologies ranging from power electronics to computer modelling to material science. The two broad approaches to fusion are magnetic confinement and inertial confinement. The first, as the name suggests, using super powerful magnets to contain the plasma to fusion conditions. Companies using that approach include CommonWealth Fusion Systems (to date the highest funded company), Tokamak Energy in the UK, and Renaissance Fusion, which is using a stellarator design. Inertial confinement relies on higher densities to create fusion as inertia holds together the plasma for tiny amounts of time. Prominent start ups taking that approach include General Fusion and First Light Fusion, both of which are building pilot facilities at Culham in the UK. Another company of note is Helion, which has a slightly different approach using different molecules for its fusion reaction and a way to directly extract the electricity (rather than producing heat + steam). CFS and Helion are talking about net electricity this decade, but it remains to be seen.

Wow - that was a lot! Well done if you’ve made it this far. I hope you agree that it worth taking the space for this one as low-carbon electricity is really the key to our climate goals and broader long-term ambitions. However, our energy system today is mostly made of molecules (hydro-carbons) and there will be certain applications that we’ll struggle to electrify. We also use molecules for their own right and not just as energy carries - we call them chemicals. Decarbonising the chemical industry is a huge task in itself. I’ll tackle both these areas in the next post in this series.